XABCD TRADING

Position Size Calculator for NinjaTrader 8. Draw It. Size It. Send It.

Click your entry. Click your stop. We calculate the contracts, build the OCO bracket, and send it to your broker—in one motion.

See it In Action!

Auto-Sized

9 risk modes. Contracts calculated instantly.

One-Click Send

Entry + stops + targets. Linked and ready.

Smart Targets

Split across levels your way.

Drag to Adjust

Live orders move when you do.

NinjaTrader Makes This Way Too Complicated

You see the trade. You know your stop. But now you're digging through ATM templates, adjusting quantities manually, and hoping you set everything right before price moves without you.

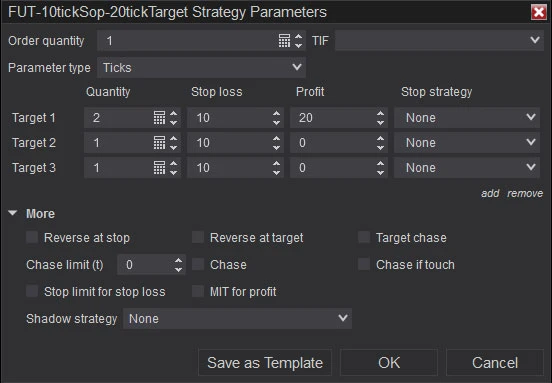

The Built-In Way

ATMs are one way—but they're clunky for fast execution. They don't adjust to your stop distance. They don't calculate size based on your risk. And by the time you've configured one, the setup is gone.

ATMs can manage your exits—but they have no idea how big your trade should be.

Simpler to Use. More Powerful Too.

See it before you send it — Preview your full bracket—size, stops, targets—before a single order hits the market.

Manage everything on the chart — Drag your stops, targets, or breakeven and orders update live. No windows. No menus. Just move it.

Lock to the market — Pin your entry to current price—it follows every tick. Pin stops and targets too. Unpin when you're ready to send.

Need speed? — Over 38 customizable hotkeys. Submit, flip, scale—without touching the mouse.

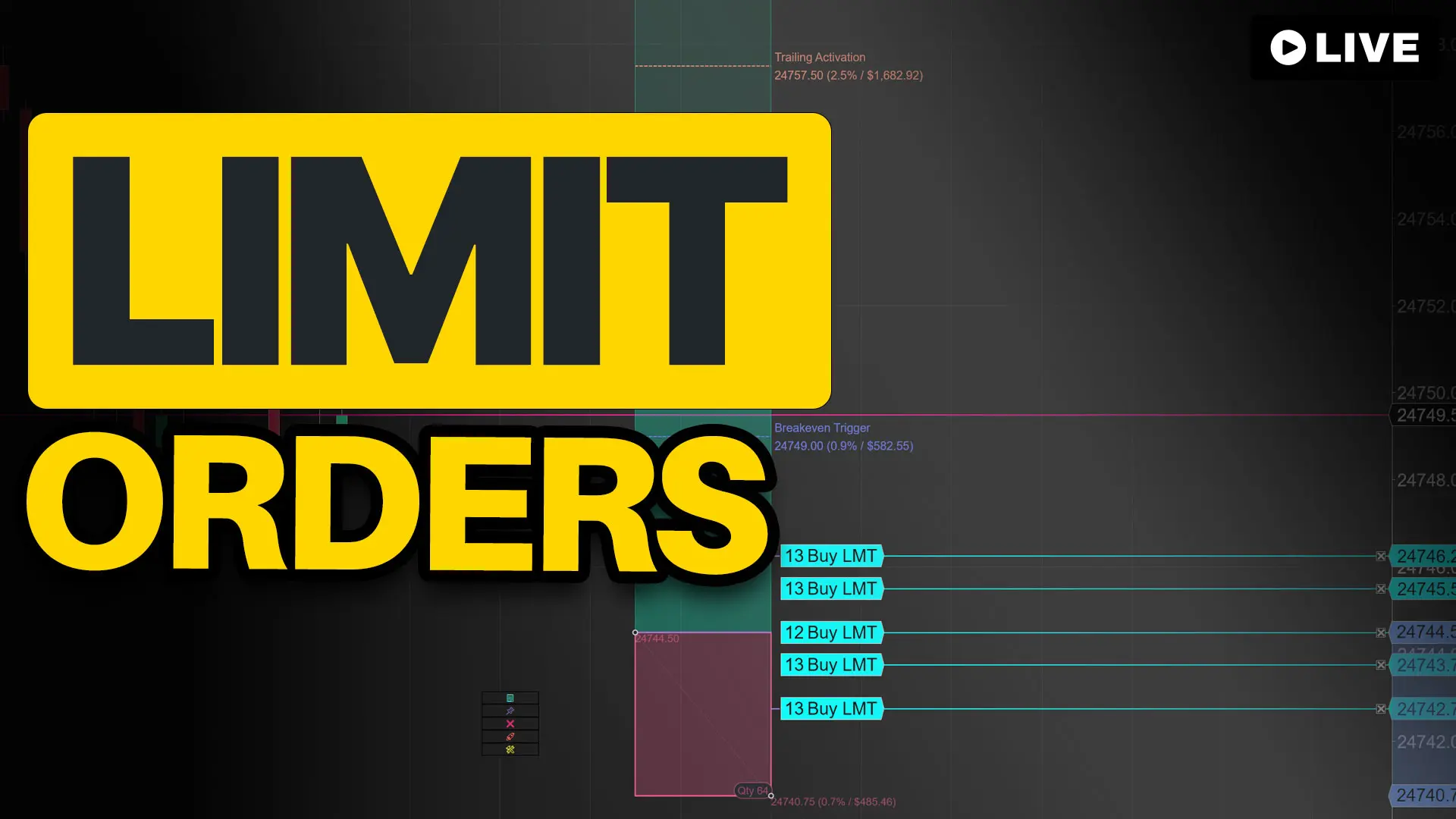

Multiple targets? — Add as many profit levels as you need. The tool allocates contracts automatically—even, front-heavy, back-heavy, or your own split.

Commission-aware breakeven - We include your commission in the breakeven calculation. Stop exiting at a loss thinking you broke even—this feature alone covers the cost of the tool.

Position Sizing for NinjaTrader That Actually Works

What Makes It Different

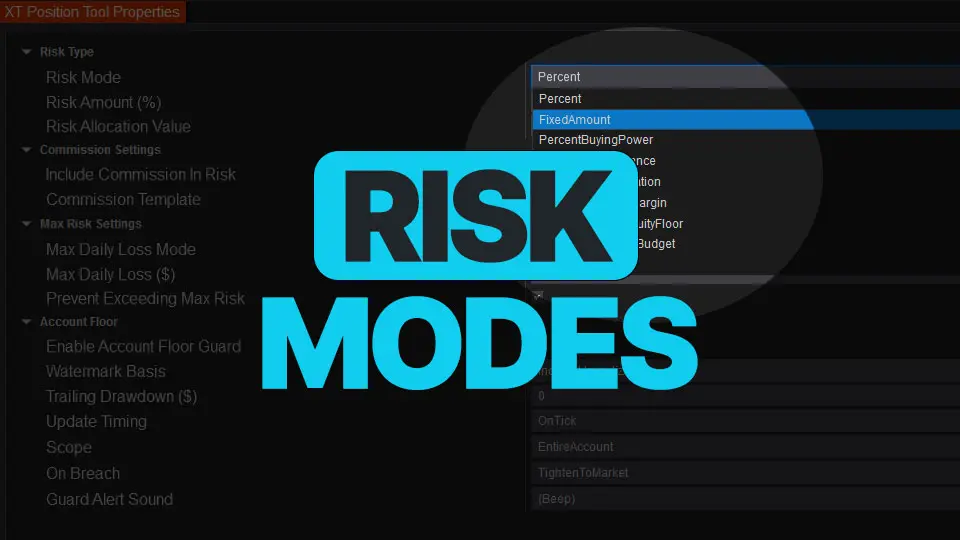

9 risk modes — Including percent of account, fixed dollar, daily loss budget, buying power, and net liquidation. You choose how risk gets calculated.

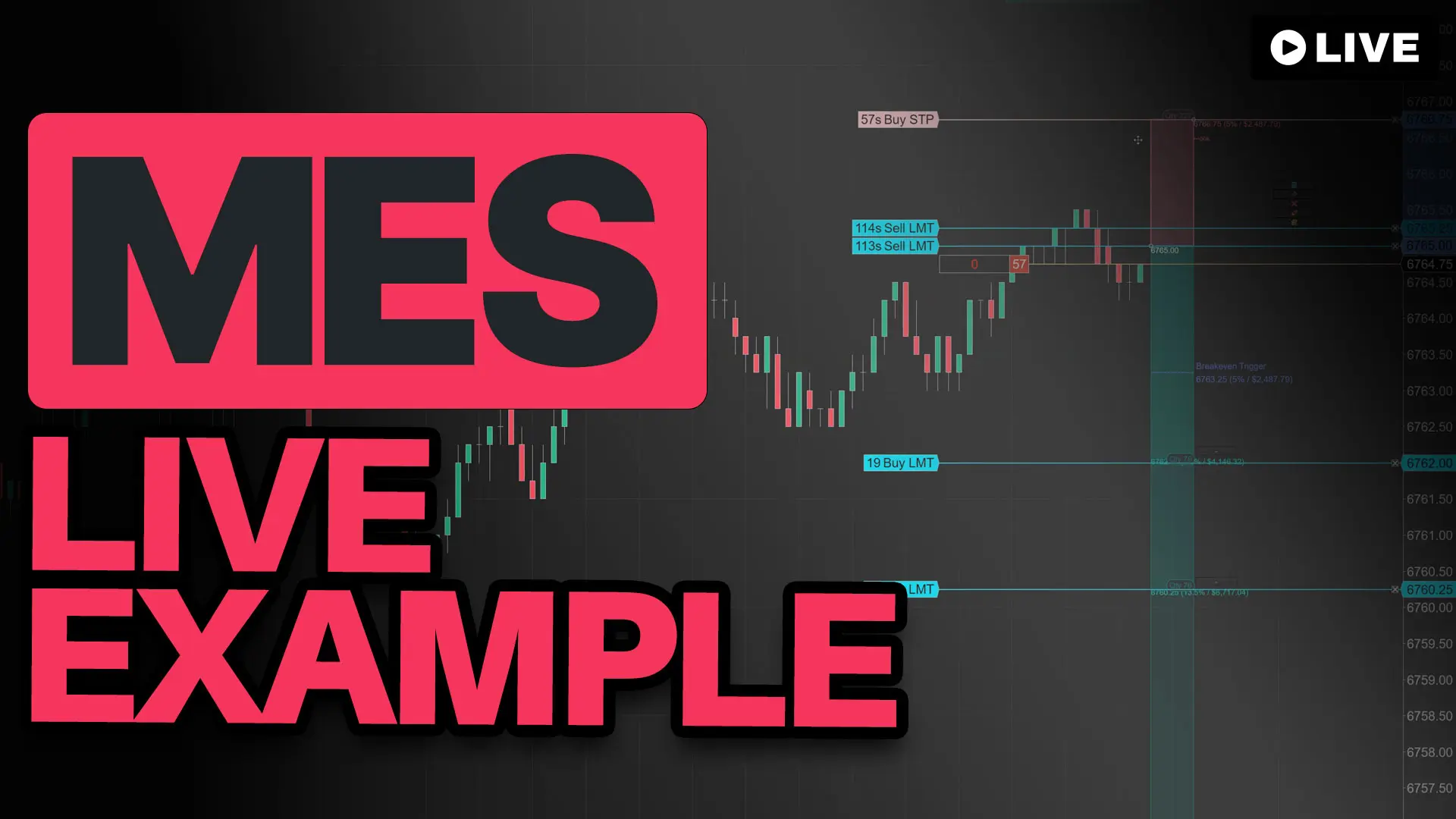

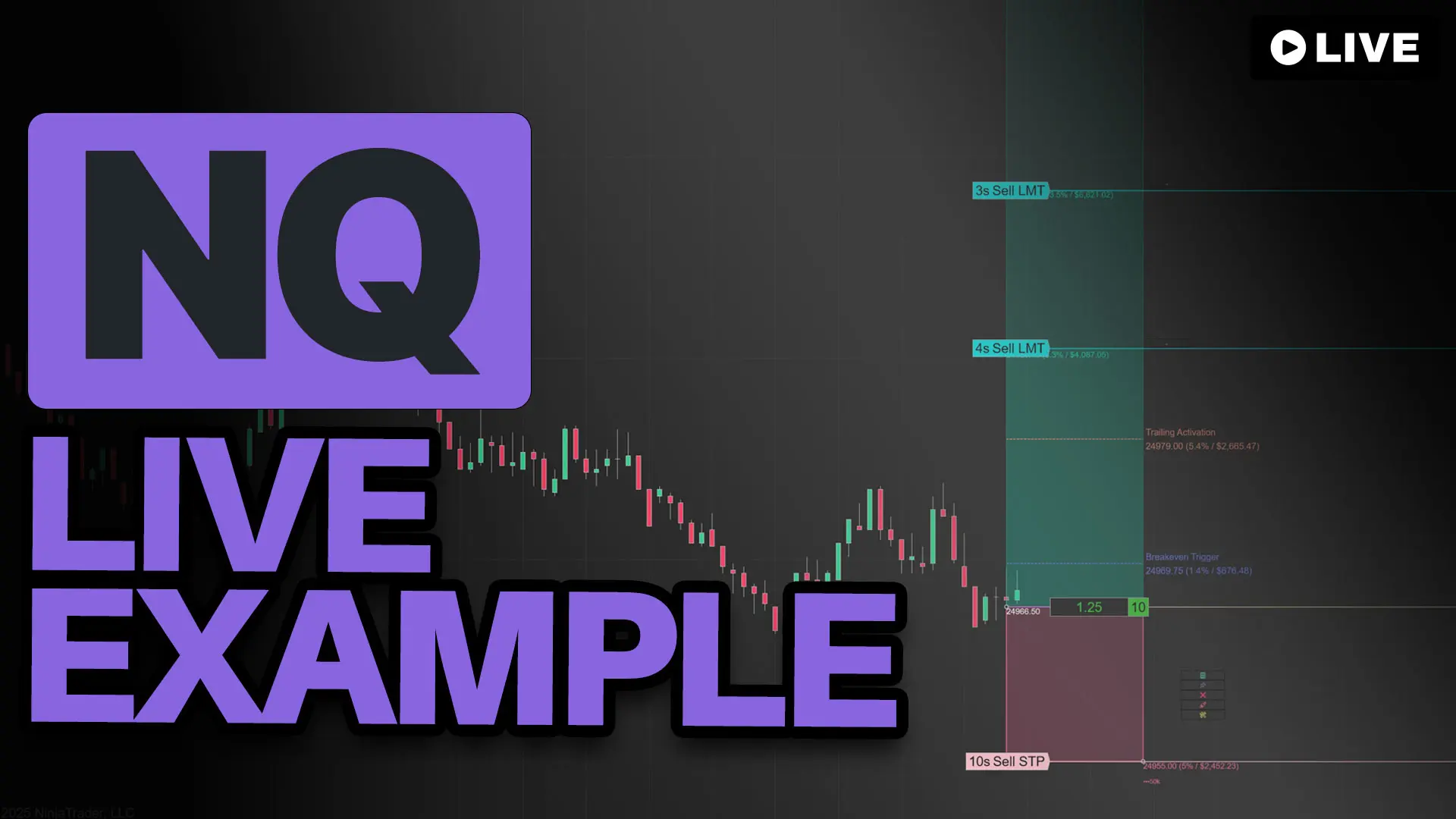

Works with any instrument — Futures, forex, stocks, crypto. Tick values and currency conversions handled automatically.

Any order type — Market, limit, stop market, stop limit, MIT. Submit what you need, how you need it.

Commission-aware — Deducts commission from your risk budget so your size is accurate.

Works with any instrument — Futures, forex, stocks, crypto. Tick values and currency conversions handled automatically.

Any order type — Market, limit, stop market, stop limit, MIT. Submit what you need, how you need it.

Commission-aware — Deducts commission from your risk budget so your size is accurate.

What It Does

The position size calculator NinjaTrader traders have been asking for.

Draw two points—entry and stop. The tool instantly calculates your position size based on your risk settings and syncs the quantity to Chart Trader. One click sends the complete OCO bracket: entry, stop, and targets—linked and ready.

No spreadsheet. No mental math. No ATM hunting.

How Does It Work?

1

Draw It – Click entry → Click stop → Done. Your trade appears on the chart.

2

Automatically Sized – Position size calculates automatically based on your risk settings. No math required.

3

Submit It – One click sends your entry, stop, and targets to your broker as a complete order package.

4

Automate It – Optional: Auto-breakeven, trailing stops, and daily loss limits run in the background.

What's Under the Hood

Ghost Orders

See your full trade and size before you send it. Ghost Orders display your entry, stop, and targets directly on the chart—drag any anchor and watch risk/reward update in real time. Nothing hits your broker until you click submit.

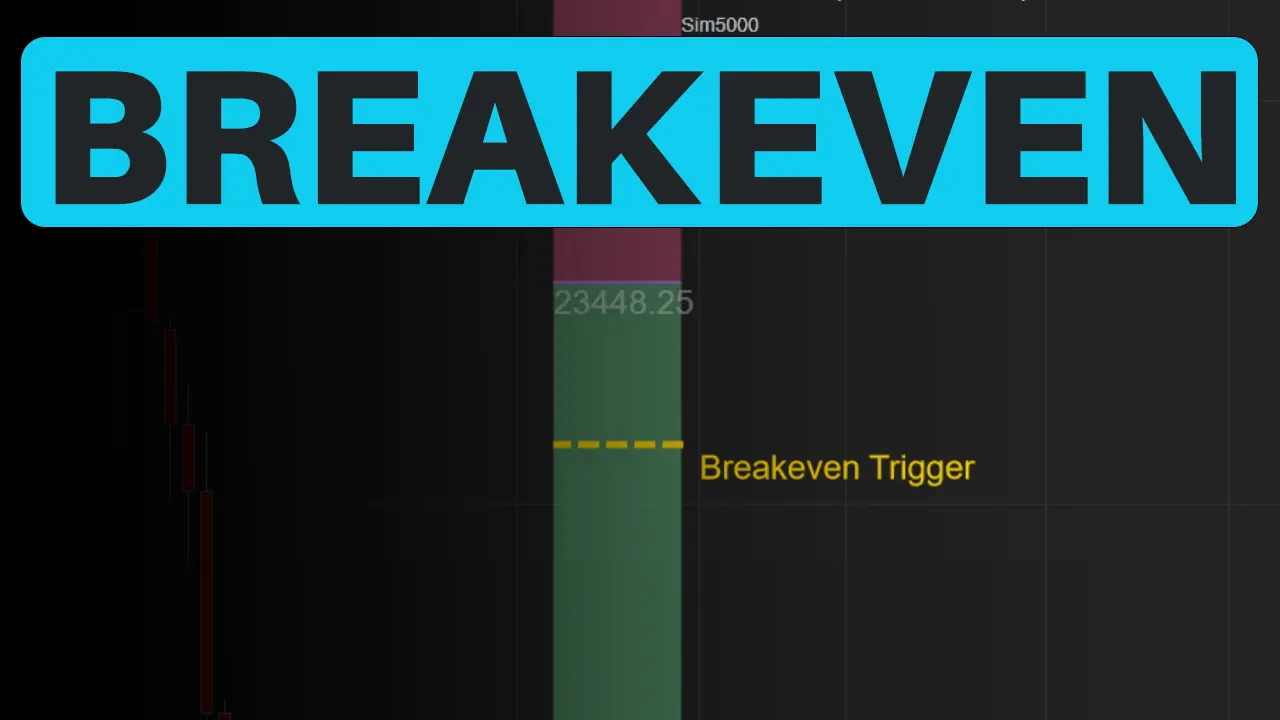

Automated Breakeven

Price moves in your favor? Your stop moves too. Auto Break-Even shifts your stop to entry automatically—no babysitting required. Set your trigger once and let it run.

Risk Guard‑Rails

Set a max risk per trade. If your stop is too wide, the tool clamps it automatically—no oversized positions, no blown budgets. You stay within your limits even when you're moving fast.

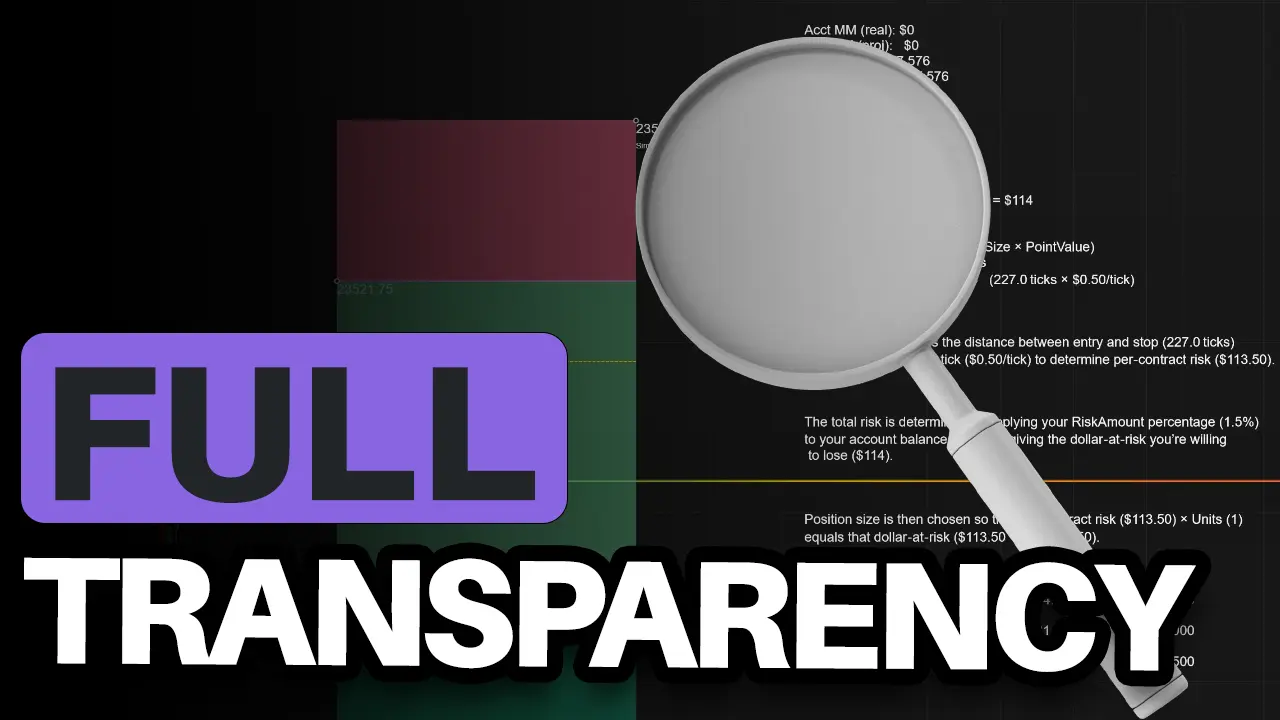

Full Transparency

See exactly what's at risk before you trade. Margin requirements, per-contract risk, total exposure—all visible on your chart. No surprises. No mental math. Just the numbers you need to size with confidence.

Smart Allocations for Targets

Multiple targets? Decide how contracts get split—even, front-loaded, or back-loaded—and the tool distributes them automatically. See the exact breakdown on your chart. No spreadsheets. No manual lot sizing.

Speed - Hotkeys

Right-click or hit a hotkey—full OCO bracket submitted. Drag your lines, live orders move with them. No menus, no re-entering. 38+ hotkeys for everything else.

FAQ

Can I place both limit and market orders?

Yes—limit, market, stop market, stop limit, and MIT.

Can I set the max risk as a % or $?

Both, you can set the max risk as a "Percent" or "FixedAmount" which will use the account currency.

Can I limit my maximum loss?

There is an option to enforce the maximum risk per trade, or a daily maximum so that you can't move your stop on the position tool any further or it will prevent you from submitting orders.

Will it work if my account is in EUR/GBP/CAD?

Yes, any base currency.

Futures/forex/stocks/crypto supported?

Yes. Works with any instrument NinjaTrader supports.

Does it auto‑update the ChartTrader quantity?

Yes—your calculated size syncs automatically.

Can I submit just the entry first?

Yes, these are "Ghost Orders" and the stops and targets are placed after you enter the market, but before you enter the market you will be able to see where they will be filled with their position size.

How does the breakeven trigger work?

Set your trigger in ticks, pips, or percent—once price moves that far in your favor, your stop automatically moves to breakeven. Works the same across futures, forex, or stocks.

Is it hard to install?

One-click installer. Under a minute.

Do I pay additional for upgrades?

No, your upgrades are included with the price of the software.

How many computers can I use it on?

One license = one computer. Need two machines? Grab a double license. Either way, you can transfer to a different machine anytime.

Do you offer support?

We do! We even have remote tools if we need to assist you that way.

Secure Your Copy

Support and Upgrades Included!

Get your life-time license for our position sizing tool in NinjaTrader 8 with one simple payment.

License summary: Personal, non-transferable — assigned to one named user and one machine

Is This For You?

#1 Platform: NinjaTrader 8 - You trade NinjaTrader 8 (futures, forex, stocks)

#2Position Sizing - You want position sizing that adjusts to your stop automatically

#3Tired of ATM's - You're tired of manual calculations and ATM workarounds

#4 Learned the Hard Way - You've messed up lot sizes and paid for it

#5Prop Firm Rules - You're in an evaluation with strict daily loss limits.

#6One-Click Brackets - You want full OCO orders without digging through menus.

Probably Not, If:

#1 Your looking for a strategy (this can be used with any strategy)

#2 You want signals

One Payment. Lifetime Access.

Pay once. Use it forever. Updates included.

Personal, non-transferable — assigned to one named user and one machine