XABCD Trading

NinjaTrader 8 ATM Strategy Rules – Basic to Advanced

How to Build A NinjaTrader 8 ATM Strategy

What is A NinjaTrader 8 ATM Strategy?

NinjaTrader 8 ATM Strategy is a way of automating your trade management. And that's exactly what Advanced Trade Management stands for and for short we'll call it ATM too. You might find this useful if you trade using our XABCD pattern suite to mange your trade to break even if that is something that interest you.

Free ATM Strategy Templates: Want to grab some free ATM Strategy templates? Download them here: Free ATM Strategies

Who Should Use ATM Strategies?

Anyone who wants to automate their trade management because they might not be around or available all the time but still wants to have certain actions defined performed automatically.

Always make sure your NinjaTrader 8 ATM Strategy is tested first so that you're well aware of the actions that will be performed.

How to Create Your First NinjaTrader 8 ATM Strategy

ATM strategies can be setup and created in a number of different ways where you would enter your order.

1. Open up your order window You will see a drop down arrow where the ATM Strategy is listed. If there is no ATM Strategy listed then it will say "None"

2. Hit the down arrow and click "Custom" to start creating the ATM Strategy.

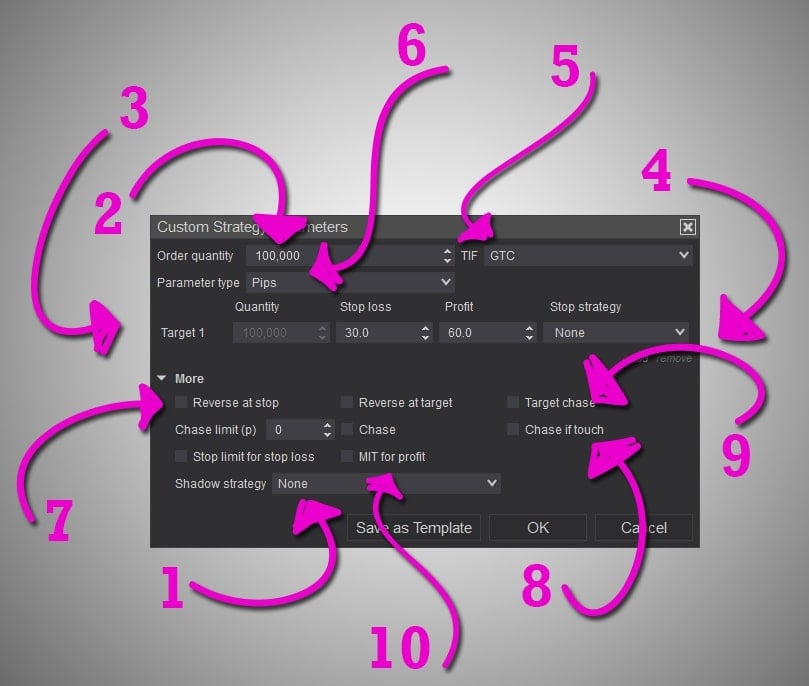

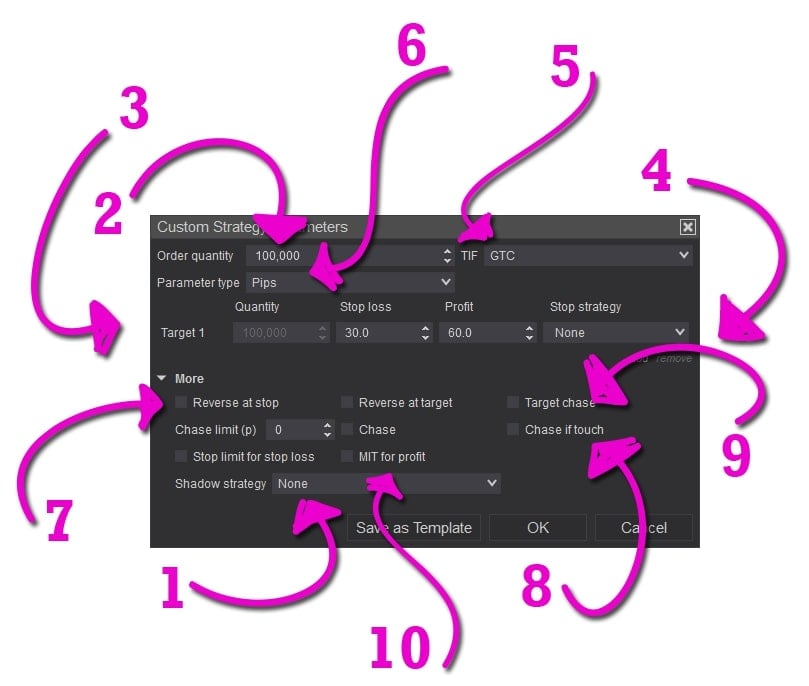

You will see the following ATM window open up, below each number will be explained.

1. Open up your order window You will see a drop down arrow where the ATM Strategy is listed. If there is no ATM Strategy listed then it will say "None"

2. Hit the down arrow and click "Custom" to start creating the ATM Strategy.

You will see the following ATM window open up, below each number will be explained.

Breaking Down the ATM Window

- Shadow Strategy: This is a way of comparing ATM strategies to another ATM strategy to compare the outcome on a single trade. Think of this as a way of testing future ATM strategies.

- Order Quantity: This is the size of the order that will be placed when you use an ATM Strategy

- Targets: You can have multiple targets or just a single one (which is shown by default). It will include profit targets as well as your stop loss and stop strategy. This will change depending on the Parameter type used for the order (eg a percentage vs a pip count etc)

- Stop Strategy: We're going to dive into this in a section below, but what this will do is allow you to define when your stop gets moved up to breakeven, or if you want to trail your stops (or not) and how close do you want to trail them. These options are all setup in different stop management ATM templates

- TIF (Time in Force): This is how long the order is good for which here is set to Good Till Cancelled (GTC). You can also have this expire at the End Of Day (EOD) etc.

- Parameter type You can set this to options like pip, point, Percent etc which is what you would probably use most trading patterns. Especially patterns since with our filters you can look at patterns that only have a 2:1 risk vs rewards and use your percentages.

- Reverse at Stop Unless your strategy has this built in, most of these options under More is probably not going to be used etc.

- Chase if Touch This will enable an auto chase if the limit price is touched (but not filled) on your entry orders. This means your stops will be brought up to breakeven once price reaches the entry order price (but not filled) until the chase limit is reached.

- Target Chase This will enable an auto chase if the limit price is touched (but not filled) on your profit target orders up until the point the chase limit is reached.

- MIT for profit means that MIT orders will be used for the targets

The most common settings will be your order quantity, Parameter type, Targets with Stop Strategies. Most of the time you won't be using what is under "More".

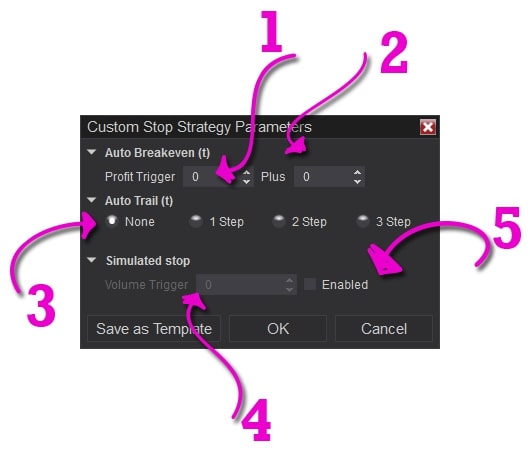

Adding The ATM Stop Strategy

The ATM Stop Strategy is a neat tool for creating more advanced ATM Strategies inside of NinjaTrader 8. The whole goal here is to reduce risk

- Profit Trigger: This is the amount you have to be profitable for the auto break-even would happen. So if you have this setup to 25 pips, once you are up 25 pips the stop will move to break-even.

- Plus: This is the amount that is added to the breakeven which can be used if you're scaling and using averages.

- Targets: You can have multiple targets or just a single one (which is shown by default). It will include profit targets as well as your stop loss and stop strategy. This will change depending on the Parameter type used for the order (eg a percentage vs a pip count etc)

- Volume Trigger: The volume amount that will simulate the stop movement.

- Simulated Stop: This is for forward walking testing in a similar way of the shadow order .

Want to Download NinjaTrader 8 ATM Templates?

Below we'll add in some ATM templates you can start using with your trading. You can find some installation instructions below, so please read them carefully.

Installation Instructions (Please Read):

- Unzip the files (you will have a bunch of .xml files)

- Paste them into your Documents\NinjaTrader 8\templates\AtmStrategy folder

Get Your Free ATM Templates

Tell us where we should send the ATM templates?

We're going to start to gather our most recent templates up right after you tell us where to send them. Usually this is done very quickly but at the longest it will take is 12 hours (mainly on weekends).

Jun. 17, 2025

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

May. 28, 2025

NinjaTrader 8.1.5 – They FINALLY Did It!

Apr. 30, 2025

Best ATM Strategy for NinjaTrader 8

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024