XABCD TRADING

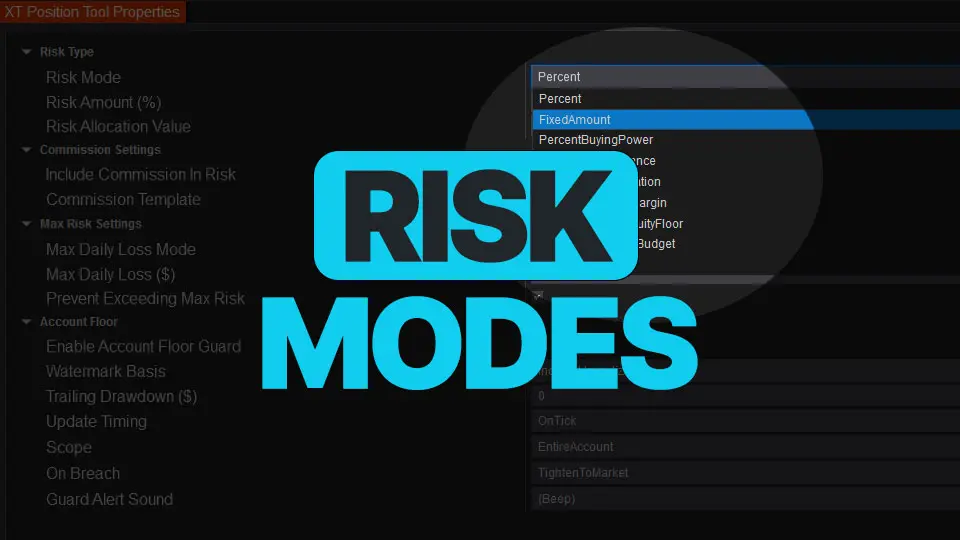

NinjaTrader Risk Management That Actually Moves the Needle

Smart position sizing isn’t “set it and forget it.” Markets move, balances change, and your constraints (margin, daily loss, prop-style floors) evolve intraday. The XABCD Position Tool gives you eight risk modes you can switch between instantly—without breaking your sizing logic or your workflow in NinjaTrader 8.

Below you’ll find what each of the 9 risk modes do, the exact formula it uses, realistic examples, and when you’d pick it over the others.

TL;DR - Pick the right mode fast.

Most Used:

Percent of Account Value: Classic “risk X% of account.” Good default for most traders.

Fixed Dollar Amount:Hard cap per trade. Ideal for consistency across instruments.

Other Options:

Percent of Buying Power: Scales risk with your broker’s leverage. Futures traders love this.

Percent of Cash Balance: Conservative; ignores unrealized swings.

Percent of Net Liquidation: Equity-aware; includes unrealized PnL.

Percent of Available Margin: Squeeze or protect margin headroom.

Percent of Trailing Equity Floor: Prop-firm / evaluation-guard friendly.

Percent of Daily Loss Budget: Stay within your daily max-loss automatically.

Fixed Quantity Override: Skip dollars/percent entirely; explicit contract count.

Percent of Account Value: Classic “risk X% of account.” Good default for most traders.

Fixed Dollar Amount:Hard cap per trade. Ideal for consistency across instruments.

Other Options:

Percent of Buying Power: Scales risk with your broker’s leverage. Futures traders love this.

Percent of Cash Balance: Conservative; ignores unrealized swings.

Percent of Net Liquidation: Equity-aware; includes unrealized PnL.

Percent of Available Margin: Squeeze or protect margin headroom.

Percent of Trailing Equity Floor: Prop-firm / evaluation-guard friendly.

Percent of Daily Loss Budget: Stay within your daily max-loss automatically.

Fixed Quantity Override: Skip dollars/percent entirely; explicit contract count.

Percent of Account Value

What it Does

Applies your RiskAmount % to either: RiskAllocationValue (if you’ve set one), or your live AccountCash balance.

Benefits

Always-sized-for-today’s account. Your risk per trade updates automatically as your balance changes. Grow from $25,000 → $30,000? Your 1% risk moves from $250 → $300. Take a drawdown to $20,000? It dials back to $200—protecting you without manual tweaks. That’s self-calibrating risk you never have to remember to change.

Compounding—without thinking about it. Keeping risk as a fixed % means winners naturally scale your position size up over time, accelerating growth while keeping the same risk profile per trade. It’s the simplest path to compounding returns with consistent risk.

Consistency across instruments. ES, NQ, CL—ticks and margins differ, but your risk stays constant. 1% is 1%, no matter what you trade. Our tool translates that % into the exact contract count and OCO structure on the chart—apples-to-apples risk across everything you touch.

Built-in drawdown discipline. Because the dollar risk shrinks when your balance shrinks, you avoid the classic spiral of “same size while equity is lower.” Your max pain is capped proportionally on every trade—fewer account-killer streaks.

Use only the slice you want with RiskAllocationValue. Don’t want your full account dictating size? Set an allocation (e.g., $10,000 of a $50,000 account). Your 1% risk now equals $100 per trade—clean, controlled, and perfect for:

Prop/eval style trading where you want a hard, smaller risk pool

Ring-fencing capital for a new strategy without touching the rest

Psychology: smaller, deliberate risk = calmer execution

Prop/eval style trading where you want a hard, smaller risk pool

Ring-fencing capital for a new strategy without touching the rest

Psychology: smaller, deliberate risk = calmer execution

Examples

$50,000 cash at 1.5% ⇒ $750 risk

$80,000 cash, RiskAllocationValue = $200,000 at 0.5% ⇒ $1,000 risk

$60,000 cash at 4% ⇒ $2,400 risk

$80,000 cash, RiskAllocationValue = $200,000 at 0.5% ⇒ $1,000 risk

$60,000 cash at 4% ⇒ $2,400 risk

Practical Use Case

Default choice if you manage risk against a known capital base or an allocation your business uses internally.

Fixed Dollar Amount

What it Does

It risks exactly your chosen dollar budget per trade (RiskAmountFixed), auto-sizing contracts so the dollar risk stays constant regardless of instrument or stop distance.

Benefits

Total dollar control—zero surprises. Pick the exact number you’re willing to lose per trade ($50, $100, $250, whatever). No percentages, no mental math—just a hard cap. That’s clean discipline for new strategies, choppy markets, or funded/eval accounts.

Perfect for inconsistent stop sizes. Your stop might be 6 ticks on one setup and 20 on the next. Fixed $ auto-adjusts quantity so the same dollar risk holds every time. Your edge stays about trade quality, not accidental over/under-sizing.

Stress-reducer during drawdowns. When emotions run hot, a fixed dollar budget prevents “revenge-sizing.” You keep the same, predictable risk, making it easier to execute the plan and review results apples-to-apples.

Great for A/B testing a new idea. Lock $100 risk and test across instruments/times. Because risk is fixed, your performance comparisons stay clean and analyzable—no noisy variance from changing dollar risk.

Future-proof switching. XT tracks the current account base behind the scenes, so when you switch back to a percent mode, your percent ⇄ dollar conversions are still accurate. No recalibration headaches.

Perfect for inconsistent stop sizes. Your stop might be 6 ticks on one setup and 20 on the next. Fixed $ auto-adjusts quantity so the same dollar risk holds every time. Your edge stays about trade quality, not accidental over/under-sizing.

Stress-reducer during drawdowns. When emotions run hot, a fixed dollar budget prevents “revenge-sizing.” You keep the same, predictable risk, making it easier to execute the plan and review results apples-to-apples.

Great for A/B testing a new idea. Lock $100 risk and test across instruments/times. Because risk is fixed, your performance comparisons stay clean and analyzable—no noisy variance from changing dollar risk.

Future-proof switching. XT tracks the current account base behind the scenes, so when you switch back to a percent mode, your percent ⇄ dollar conversions are still accurate. No recalibration headaches.

Examples

RiskAmountFixed = $500 ⇒ always $500

RiskAmountFixed = $0 ⇒ $0 (prevents sizing)

Switching from 2% on a $40,000 base auto-sets RiskAmountFixed = $800

RiskAmountFixed = $0 ⇒ $0 (prevents sizing)

Switching from 2% on a $40,000 base auto-sets RiskAmountFixed = $800

Practical Use Case

If you want identical risk per trade—regardless of account swings or leverage.

Percent of Buying Power

What it Does

Bases risk on broker-reported buying power. If the query fails, we use the last cached buying power to keep you moving.

Benefits

Leverage-aware sizing—automatically. Buying power already reflects your broker’s leverage and margin rules. Risking, say, 0.5% of buying power scales positions to what you can actually deploy right now, not just what your cash balance says.

Consistent risk across volatile margin conditions. When brokers tighten or loosen intraday margin, your risk per trade adjusts in step. You get stable risk discipline even when leverage changes under the hood.

Perfect fit for futures & active day trading. Futures traders live on buying power. This mode translates your BP % into precise contracts so your risk stays instrument-agnostic and time-of-day aware (intraday vs. overnight requirements).

Keeps you moving—even if data blips. If the buying-power query fails for a moment, XT automatically uses your last cached value. No interruptions. No forced guesswork. You stay in flow.

Cleaner compliance for prop/eval accounts. Because risk is tied to the same metric your broker/prop evaluates, you’re less likely to bump into margin or drawdown triggers. It’s a simpler way to stay within the guardrails.

Consistent risk across volatile margin conditions. When brokers tighten or loosen intraday margin, your risk per trade adjusts in step. You get stable risk discipline even when leverage changes under the hood.

Perfect fit for futures & active day trading. Futures traders live on buying power. This mode translates your BP % into precise contracts so your risk stays instrument-agnostic and time-of-day aware (intraday vs. overnight requirements).

Keeps you moving—even if data blips. If the buying-power query fails for a moment, XT automatically uses your last cached value. No interruptions. No forced guesswork. You stay in flow.

Cleaner compliance for prop/eval accounts. Because risk is tied to the same metric your broker/prop evaluates, you’re less likely to bump into margin or drawdown triggers. It’s a simpler way to stay within the guardrails.

Examples

$75,000 buying power at 1% ⇒ $750

$120,000 buying power at 2.5% ⇒ $3,000

API fails; last known $50,000 at 1% ⇒ $500

$120,000 buying power at 2.5% ⇒ $3,000

API fails; last known $50,000 at 1% ⇒ $500

Practical Use Case

You want risk to scale with leverage availability (common for futures and margin users).

Percent of Cash Balance

What it Does

Measures against cash only (not unrealized PnL). Uses cached cash on temporary dropouts.

Benefits

Ultra-clean, noise-free sizing. By keying off cash only, your risk per trade isn’t whipsawed by unrealized swings. You size from what’s actually in the wallet—simple, steady, and predictable.

Great for conservative or capital-segmented trading. If you park profits or keep a portion of funds untouched, cash-based sizing keeps risk grounded to that known, liquid base. Ideal for traders who want tight guardrails without tracking floating PnL.

Crystal-clear budgeting across sessions. Overnight moves won’t inflate or shrink your next trade’s risk. You get consistent dollar exposure session-to-session, which makes reviews and journaling cleaner.

Keeps you executing during hiccups. If cash can’t be fetched for a moment (API hiccup, broker lag), XT instantly falls back to last cached cash—clearly indicated—so you can place the trade now, not later.

Psychology boost. Knowing your risk is tied to cash in hand reduces hesitation and second-guessing. It’s easier to press “send” when the budget feels tangible.

Great for conservative or capital-segmented trading. If you park profits or keep a portion of funds untouched, cash-based sizing keeps risk grounded to that known, liquid base. Ideal for traders who want tight guardrails without tracking floating PnL.

Crystal-clear budgeting across sessions. Overnight moves won’t inflate or shrink your next trade’s risk. You get consistent dollar exposure session-to-session, which makes reviews and journaling cleaner.

Keeps you executing during hiccups. If cash can’t be fetched for a moment (API hiccup, broker lag), XT instantly falls back to last cached cash—clearly indicated—so you can place the trade now, not later.

Psychology boost. Knowing your risk is tied to cash in hand reduces hesitation and second-guessing. It’s easier to press “send” when the budget feels tangible.

Examples

$40,000 cash at 1.5% ⇒ $600

$55,000 cash at 3% ⇒ $1,650

Live cash reads 0, cached is $35,000 at 2% ⇒ $700

$55,000 cash at 3% ⇒ $1,650

Live cash reads 0, cached is $35,000 at 2% ⇒ $700

Practical Use Case

You prefer a conservative base that ignores floating gains/losses.

Percent of Net Liquidation

What it Does

Targets full account equity (cash + unrealized PnL). Falls back to cached equity if needed.

Benefits

Equity-true risk—always. Sizing from net liq means your risk reflects your actual account value right now—cash plus open PnL. You don’t under-size after a strong run or over-size in a drawdown. It’s precision risk tied to reality.

Compounds with your edge, instantly. When unrealized gains lift equity, your % risk scales up naturally; when trades are red, it scales down. You get automatic compounding with built-in brake control—no manual recalcs.

Cleaner alignment with broker/prop metrics. Many brokers and prop firms think in net liq. Tying your sizing to the same benchmark helps you respect trailing thresholds and avoid surprise breaches.

Great for active portfolios. If you run multiple positions, net liq captures their live impact so your next trade sizes to the whole picture, not just cash. That keeps your risk budget coherent across the book.

No stall during data hiccups. If live equity temporarily can’t be fetched, XT automatically uses your last cached net liq. You keep trading; XT clearly indicates the fallback so you know what it sized from.

Compounds with your edge, instantly. When unrealized gains lift equity, your % risk scales up naturally; when trades are red, it scales down. You get automatic compounding with built-in brake control—no manual recalcs.

Cleaner alignment with broker/prop metrics. Many brokers and prop firms think in net liq. Tying your sizing to the same benchmark helps you respect trailing thresholds and avoid surprise breaches.

Great for active portfolios. If you run multiple positions, net liq captures their live impact so your next trade sizes to the whole picture, not just cash. That keeps your risk budget coherent across the book.

No stall during data hiccups. If live equity temporarily can’t be fetched, XT automatically uses your last cached net liq. You keep trading; XT clearly indicates the fallback so you know what it sized from.

Examples

$150,000 net liq at 1% ⇒ $1,500

$220,000 net liq at 0.75% ⇒ $1,650

Cached $180,000 at 2% ⇒ $3,600

$220,000 net liq at 0.75% ⇒ $1,650

Cached $180,000 at 2% ⇒ $3,600

Practical Use Case

You want risk aligned with your true, real-time equity.

Percent of Available Margin

What it Does

Computes available margin as Cash − max(InitialMargin, MaintenanceMargin). If margins exceed cash, it clamps to zero.

Benefits

Risk that respects margin—automatically. Your sizing keys off what’s truly deployable after margin requirements. XT uses Cash − max(IM, MM) so you never size from fantasy dollars—only from real, tradeable headroom.

Safety-first clamp at zero. If margin spikes or cash is thin, available margin can go negative. XT hard-clamps to zero, preventing oversizing and margin calls. It’s a built-in guardrail when markets get jumpy.

Sharper control during volatility. When brokers raise Initial/Maintenance margins intraday, your available margin shrinks and XT dials risk down in sync. You keep a consistent risk framework even as requirements change under you.

Perfect for multi-position days. Running a book? As existing positions consume margin, the available margin drops—and this mode auto-rightsizes your next entry. Your total portfolio risk stays coherent.

Evaluation & prop friendly. Margin headroom is often the make-or-break metric in evals. Tie risk to available margin and you avoid disqualifying over-allocations while still taking quality trades.

Safety-first clamp at zero. If margin spikes or cash is thin, available margin can go negative. XT hard-clamps to zero, preventing oversizing and margin calls. It’s a built-in guardrail when markets get jumpy.

Sharper control during volatility. When brokers raise Initial/Maintenance margins intraday, your available margin shrinks and XT dials risk down in sync. You keep a consistent risk framework even as requirements change under you.

Perfect for multi-position days. Running a book? As existing positions consume margin, the available margin drops—and this mode auto-rightsizes your next entry. Your total portfolio risk stays coherent.

Evaluation & prop friendly. Margin headroom is often the make-or-break metric in evals. Tie risk to available margin and you avoid disqualifying over-allocations while still taking quality trades.

Examples

Cash $50k, init $30k, maint $25k ⇒ avail $20k; 5% ⇒ $1,000

Cash $40k, maint $28k (> init $26k) ⇒ avail $12k; 2% ⇒ $240

Cash $10k, init $12k, maint $15k ⇒ avail $0; any % ⇒ $0

Cash $40k, maint $28k (> init $26k) ⇒ avail $12k; 2% ⇒ $240

Cash $10k, init $12k, maint $15k ⇒ avail $0; any % ⇒ $0

Practical Use Case

You need to protect margin headroom while still sizing meaningfully.

Percent of Trailing Equity Floor (Evaluation Guard)

What it Does

Anchors your risk to:

- the evaluation guard floor (if enabled), or

- your current equity, optionally trailing high − drawdown, with safe fallbacks to last known values.

Benefits

Prop-firm survival mode, automated. Tie risk to the evaluation guard floor your account must not breach. XT sizes every trade from that protected base, so your risk budget can’t accidentally outrun the rules—even when emotions try to.

Dynamic downside guardrail. Prefer your own risk floor? Use a trailing equity floor (e.g., Trailing High − Allowed Drawdown). As equity rises, the floor ratchets up; when equity dips, risk is sized from the still-protected floor, not the full account—braking losses before they snowball.

Consistent discipline through volatility. When markets whip or you’re juggling multiple positions, your per-trade risk remains a fixed % of the protected floor, not a moving target pulled around by temporary swings. That’s calm, rule-based execution.

Safe fallbacks keep you trading. If live values momentarily drop out (broker hiccup, API lag), XT uses the last known floor so you aren’t frozen at decision time. You execute now, with a clear status badge indicating the fallback.

Psychology boost for funded/eval accounts. Trading to a floor removes “What if I blow the account?” from your headspace. You focus on setup quality, while XT ensures per-trade risk stays inside the guardrails.

Dynamic downside guardrail. Prefer your own risk floor? Use a trailing equity floor (e.g., Trailing High − Allowed Drawdown). As equity rises, the floor ratchets up; when equity dips, risk is sized from the still-protected floor, not the full account—braking losses before they snowball.

Consistent discipline through volatility. When markets whip or you’re juggling multiple positions, your per-trade risk remains a fixed % of the protected floor, not a moving target pulled around by temporary swings. That’s calm, rule-based execution.

Safe fallbacks keep you trading. If live values momentarily drop out (broker hiccup, API lag), XT uses the last known floor so you aren’t frozen at decision time. You execute now, with a clear status badge indicating the fallback.

Psychology boost for funded/eval accounts. Trading to a floor removes “What if I blow the account?” from your headspace. You focus on setup quality, while XT ensures per-trade risk stays inside the guardrails.

Examples

Eval floor $80,000 at 2% ⇒ $1,600

No floor; equity $95,000, trailing high $100,000, drawdown $15,000 ⇒ guard $85,000; 1.5% ⇒ $1,275

Cached floor $70,000 at 1% ⇒ $700

No floor; equity $95,000, trailing high $100,000, drawdown $15,000 ⇒ guard $85,000; 1.5% ⇒ $1,275

Cached floor $70,000 at 1% ⇒ $700

Practical Use Case

Perfect for prop-firm rules and personal max-drawdown disciplines. Keeps risk tied to what you must defend.

Percent of Daily Loss Budget

What it does

Uses your daily loss limit − realized losses as the base (with cached values offline).

Benefits

Daily max-loss, enforced by math. You set the Daily Loss Limit (e.g., $1,000). XT subtracts realized losses so far and sizes each new trade to a fixed % of what’s left. You’ll never “accidentally” burn the entire day on one impulse click.

Self-correcting after a red morning. Down early? Your remaining budget shrinks—and XT automatically dials back per-trade risk. Up later? You still size from the remaining budget, maintaining discipline until the bell.

Perfect for prop & personal rules. Most prop programs judge you by daily drawdown. This mode keeps you inside that guardrail by design—no spreadsheet policing needed.

Clarity you can feel. Every trade answers, “What % of today’s remaining budget am I risking?” You’ll execute calmer, review cleaner, and stop the death-by-a-thousand-cuts days.

Keeps working during hiccups. If live PnL briefly can’t be fetched, XT uses your last cached budget values so you can still size and execute—clearly flagged on-chart.

Self-correcting after a red morning. Down early? Your remaining budget shrinks—and XT automatically dials back per-trade risk. Up later? You still size from the remaining budget, maintaining discipline until the bell.

Perfect for prop & personal rules. Most prop programs judge you by daily drawdown. This mode keeps you inside that guardrail by design—no spreadsheet policing needed.

Clarity you can feel. Every trade answers, “What % of today’s remaining budget am I risking?” You’ll execute calmer, review cleaner, and stop the death-by-a-thousand-cuts days.

Keeps working during hiccups. If live PnL briefly can’t be fetched, XT uses your last cached budget values so you can still size and execute—clearly flagged on-chart.

Examples

Limit $1,200, realized $400 ⇒ remaining $800; 10% ⇒ $80

Limit $500, realized $500 ⇒ remaining $0; any % ⇒ $0

Cached realized $200 on limit $1,000 ⇒ remaining $800; 5% ⇒ $40

Limit $500, realized $500 ⇒ remaining $0; any % ⇒ $0

Cached realized $200 on limit $1,000 ⇒ remaining $800; 5% ⇒ $40

Practical Use Case

You want every new trade sized to respect your daily stop automatically.

Fixed Quantity Override

What it does

Skips percent/dollar math entirely. Sizes exactly RiskFixedQuantity (clamped to non-negative). Risk display logic exits early.

Benefits

Zero math. Zero friction. Go. You tell XT “always trade N contracts,” and it does—no percent, no dollar conversions. That’s instant execution for scalpers and power users who already know their size.

Perfect for muscle-memory strategies. If your playbook is “this setup = 3 micros,” Fixed Quantity keeps your workflow identical every time, so you can focus on read, timing, and tape—not on a calculator.

Cleaner testing & training. Locking quantity makes A/B testing apples-to-apples across sessions. It’s also great for new traders practicing entries without moving risk targets around.

Safe by design. Quantity is clamped to non-negative under the hood. If you (or a script) try to pass a negative number, XT quietly guards you.

Faster UI response. Because the risk display logic exits early, the chart stays snappy. You get minimal overhead and maximum chart performance when moving entries/stops.

Perfect for muscle-memory strategies. If your playbook is “this setup = 3 micros,” Fixed Quantity keeps your workflow identical every time, so you can focus on read, timing, and tape—not on a calculator.

Cleaner testing & training. Locking quantity makes A/B testing apples-to-apples across sessions. It’s also great for new traders practicing entries without moving risk targets around.

Safe by design. Quantity is clamped to non-negative under the hood. If you (or a script) try to pass a negative number, XT quietly guards you.

Faster UI response. Because the risk display logic exits early, the chart stays snappy. You get minimal overhead and maximum chart performance when moving entries/stops.

Examples

RiskFixedQuantity = 3 ⇒ every order is 3 contracts

RiskFixedQuantity = 0 ⇒ 0 (blocks entry until raised)

RiskFixedQuantity = −5 ⇒ clamped to 0 and logged

RiskFixedQuantity = 0 ⇒ 0 (blocks entry until raised)

RiskFixedQuantity = −5 ⇒ clamped to 0 and logged

Practical Use Case

Backtesting fixed-lot strategies, instrument-specific micro-contracts, or when you want explicit size regardless of price or balance.

Practical Risk Management Tips & Gotchas

Switching modes mid-session. Safe: the tool auto-converts your last budget to the new mode’s base so you don’t get an accidental risk jump.

Missing broker values. You’ll see a non-blocking cached badge in the panel (where enabled). Sizing continues deterministically.

Reversal area vs probability. All modes manage risk—they don’t change trade probability. Use your setup rules and the reversal area you’ve defined; let the tool translate that into consistent sizing.

Zero budgets = no size. If a base collapses to zero (e.g., margins > cash, daily budget consumed), the tool returns $0 risk (or 0 qty in Fixed Quantity).

Missing broker values. You’ll see a non-blocking cached badge in the panel (where enabled). Sizing continues deterministically.

Reversal area vs probability. All modes manage risk—they don’t change trade probability. Use your setup rules and the reversal area you’ve defined; let the tool translate that into consistent sizing.

Zero budgets = no size. If a base collapses to zero (e.g., margins > cash, daily budget consumed), the tool returns $0 risk (or 0 qty in Fixed Quantity).

Which Mode Should be Your Default?

Newer traders: Percent of Account Value or Fixed Dollar Amount keep things simple and consistent.

Futures / leveraged traders: Percent of Buying Power or Available Margin adapt sizing to what the broker will actually let you deploy.

Prop / evaluation: Percent of Trailing Equity Floor aligns with trailing drawdown rules.

Strict daily discipline: Percent of Daily Loss Budget keeps every trade within the day’s remaining room.

Futures / leveraged traders: Percent of Buying Power or Available Margin adapt sizing to what the broker will actually let you deploy.

Prop / evaluation: Percent of Trailing Equity Floor aligns with trailing drawdown rules.

Strict daily discipline: Percent of Daily Loss Budget keeps every trade within the day’s remaining room.

Final Word: Make Risk a Feature, Not a Flaw

Great traders don’t win because every setup is perfect—they win because every position size is. With the XABCD Position Tool, risk stops being a guess and becomes an input you control: percent of account, buying power, net liq, available margin, trailing equity floor, daily loss budget—even a hard fixed dollar or fixed quantity when that’s what the plan calls for. No spreadsheets, no mental math mid-candle, no “I thought my stop was smaller.” Just clean conversions into the exact contracts your rules demand.

If your strategy already defines a clear reversal area, this is the missing piece that turns rules into fills—consistently, even when broker data blips. Flip modes as your day evolves, keep dollars ↔ percent ↔ quantity in perfect sync, and trade like someone who expects to be here tomorrow.

When you can size on command, you can scale on purpose. Turn risk into your most reliable tool—and let the market be the variable, not your exposure.

Sep. 28, 2025

NinjaTrader Risk Management That Actually Moves the Needle

Sep. 25, 2025

NinjaTrader 8.1.6 — The “No Fluff” Tour (Speed, Clarity, Fewer Clicks)

Sep. 20, 2025

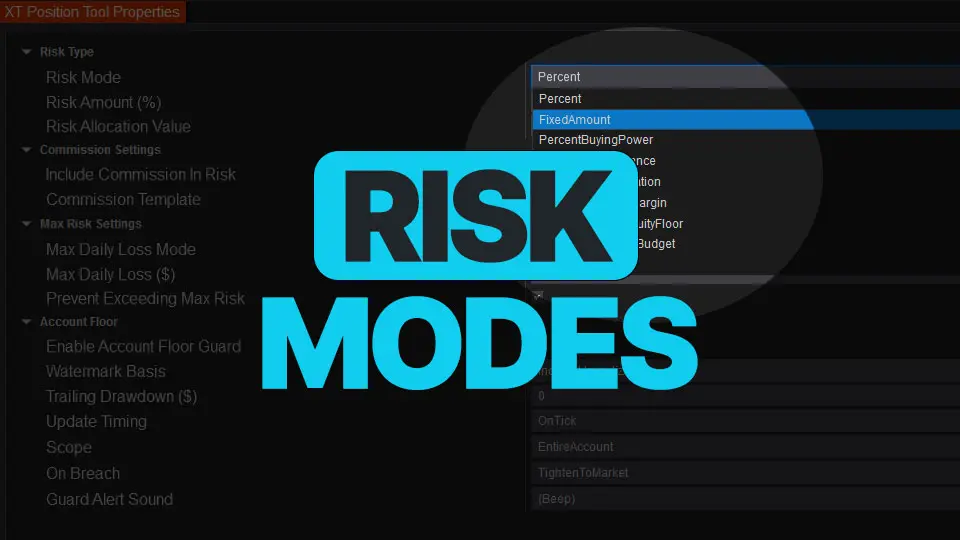

Meet the XABCD Pattern Meter (Real-Time Clarity)

Sep. 13, 2025

XT PriceLine: Dynamic Colors That Let You See Every Tick

Aug. 30, 2025

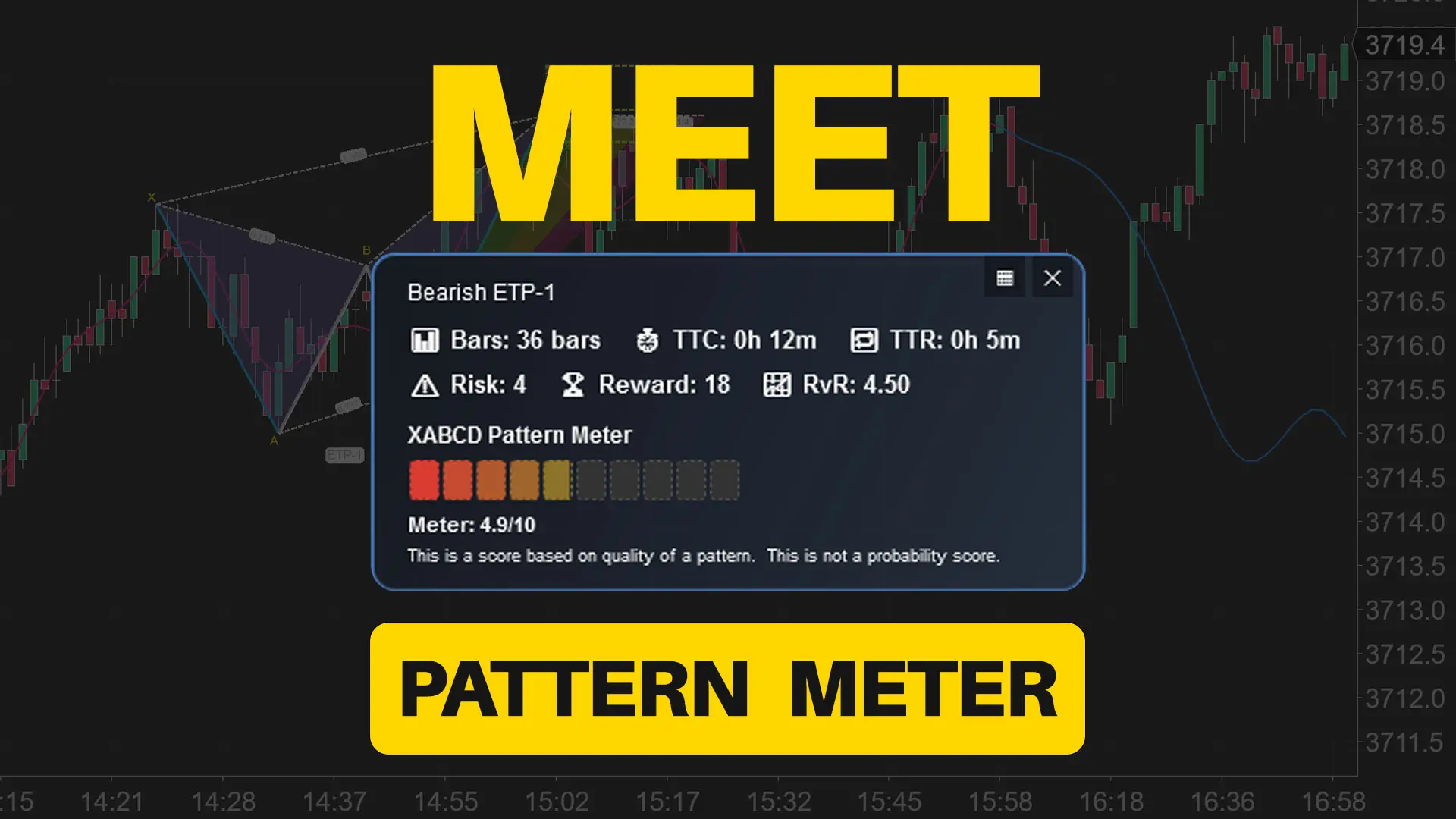

Dominate the Market with Smarter Trailing Stops in NinjaTrader

Jun. 17, 2025

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

May. 28, 2025

NinjaTrader 8.1.5 – They FINALLY Did It!

Apr. 30, 2025

Best ATM Strategy for NinjaTrader 8

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025