XABCD TRADING

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

Talking About Risk is Boring But Critical When Trading XABCD Patterns

Let’s be honest—most traders focus way too much on entries and not nearly enough on risk... because risk is boring. But if you’re serious about longevity and consistency, managing risk the right way is non-negotiable. Especially when trading something as structured and rule-based as XABCD patterns.

While it’s tempting to just risk the same dollar amount on every trade, that approach can quietly sabotage your edge. Instead, using a percentage of your account balance to determine risk gives you a built-in safety net, and it keeps your trading performance scalable and consistent—two things every XABCD trader should be aiming for.

The Problem With Fixed Dollar Risk

Let’s say you’re risking $100 on every trade—whether your account is $2,000 or $20,000. Sounds simple, but it creates big inconsistencies.

When your account is small, you’re risking a huge percentage of it

When your account grows, your risk becomes too conservative

Your position sizing doesn't reflect the trade setup or stop distance

This approach doesn’t adapt to changing market conditions, stop sizes, or even account size. It’s static, and static doesn’t work well in a dynamic environment.

Why Risking a % of Your Account Just Works

Here’s why percentage-based risk is a better fit, especially with XABCD patterns:

It Grows With You

If your account grows, so does the size of your positions. You’re always risking the same portion of your capital—not more, not less. This keeps your exposure consistent, even as your account evolves.

It Shrinks During Drawdowns

Losing streaks happen. By risking a percentage, your dollar risk naturally reduces as your balance drops. This acts as a self-correcting buffer and helps you recover faster.

It Keeps Your Emotions in Check

XABCD trading is rules-based, and your mindset needs to match that logic. When your risk is too large, emotions creep in. You hesitate, close early, or avoid perfectly good setups. Using a % keeps you calm and focused.

It Makes Trade Reviews More Meaningful

Tracking performance in R-multiples (like 1R, 2R, etc.) becomes easy. This is a smart way to evaluate your trades based on structure quality and execution—not just dollar outcomes.

It Simplifies Optimization

Whether you’re testing pattern filters, time-based confirmations, or different timeframes, percentage risk keeps your backtest results more accurate and scalable.

Quick Comparison: Fixed Dollar vs 2% Risk

Let’s say you’ve got a $5,000 account.

Fixed Dollar Risk ($100 each trade):

Risk stays at $100, no matter what

After 4 losses, you’re down $400

You’re still risking $100, now 2.2% of your account

Percentage Risk (2% each trade):

Trade 1: $100 risk

Trade 2: $98 risk

Trade 3: $96 risk

Trade 4: $94 risk

Total loss: $388 (less than fixed model)

Now imagine you hit a few winners at 2R:

Fixed: 4 x $200 = $800 gain

Percentage: You gain 2R on each trade, compounding as your account recovers

It’s smoother, safer, and more in tune with how markets move.

How to Apply This in Your XABCD Workflow

You’re probably already using some tools to identify your patterns and Reversal Areas. Adding % risk to your workflow is just one more layer of discipline.

Here’s how to do it:

Decide on a base risk percentage (1–2% is common)

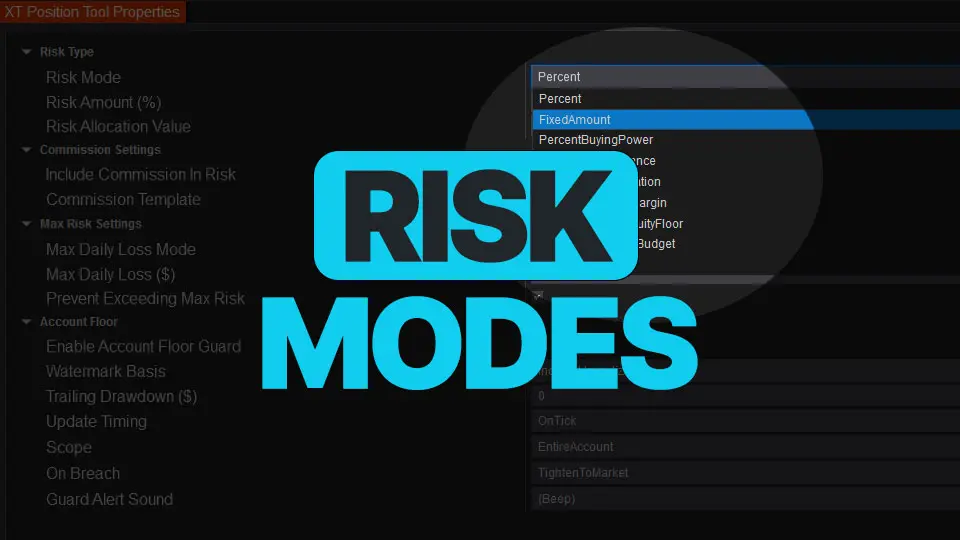

Use a position size calculator or built-in tool to calculate trade size based on stop distance

Track results using R-multiples to measure consistency

If your pattern tools support it, some will even auto-size your positions based on risk. Take advantage of that.

Optional: Adjust % Based on Pattern Strength

Not every pattern is created equal. Sometimes you’ve got confluence from multiple timeframes. Other times it’s a standalone setup with weaker confirmation. Try this risk tiering:

2% risk on high-probability setups

1% on average-quality structures

0.5% when testing new filters or timeframes

This adds flexibility while keeping you grounded in a consistent framework.

Final Thoughts: Trade Smart, Risk Smarter

XABCD patterns already give you structure, clarity, and consistency. But none of that matters if your risk is all over the place.

Using a percentage of your account as your risk model is one of the best upgrades you can make. It scales with you, protects you, and supports the methodical mindset that XABCD trading is all about.

Bottom line: If you want to keep growing your account and your skills, stop thinking in dollars and start thinking in percentages.

Make your risk work as precisely as your patterns.

Sep. 28, 2025

NinjaTrader Risk Management That Actually Moves the Needle

Sep. 25, 2025

NinjaTrader 8.1.6 — The “No Fluff” Tour (Speed, Clarity, Fewer Clicks)

Sep. 20, 2025

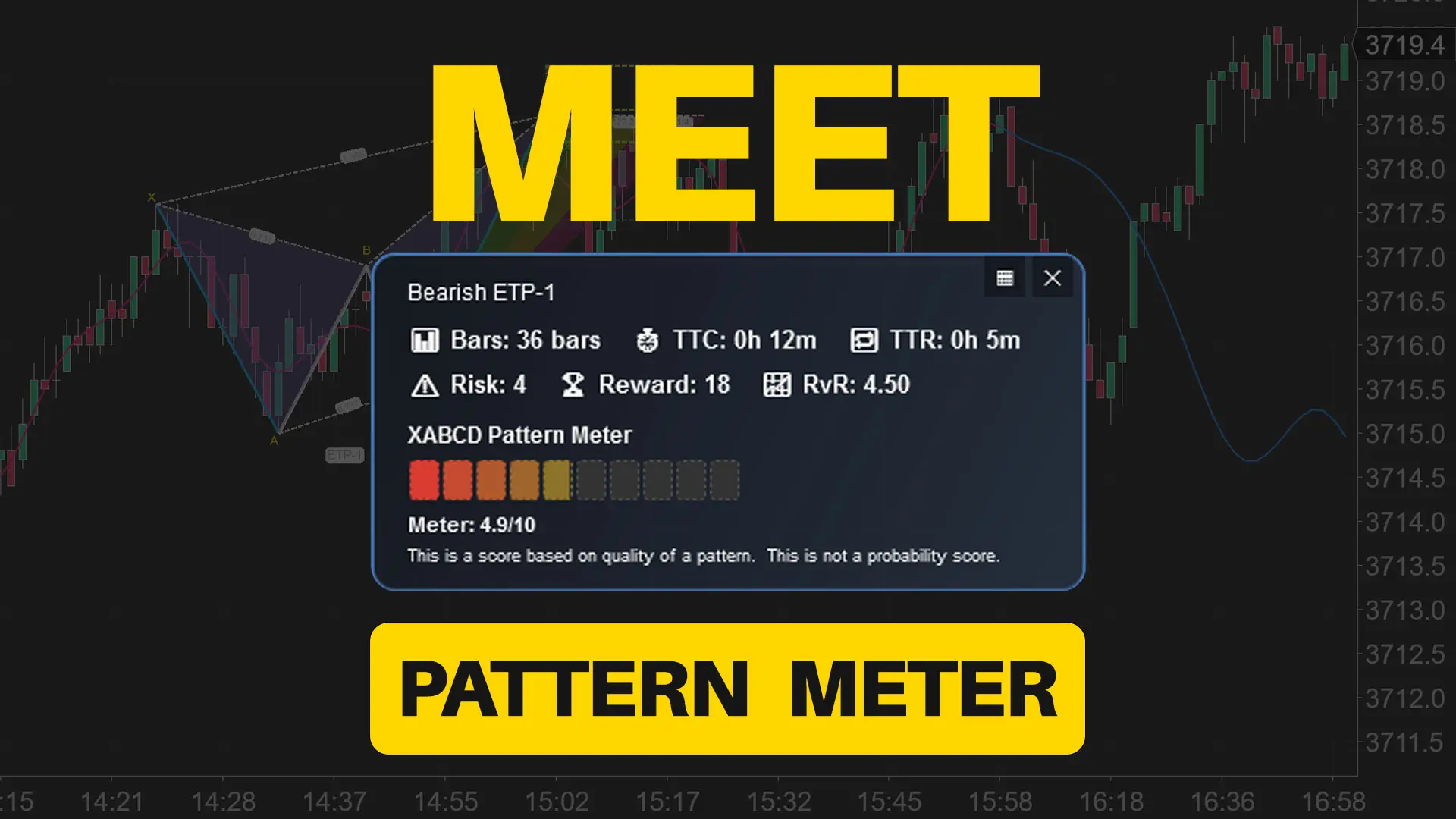

Meet the XABCD Pattern Meter (Real-Time Clarity)

Sep. 13, 2025

XT PriceLine: Dynamic Colors That Let You See Every Tick

Aug. 30, 2025

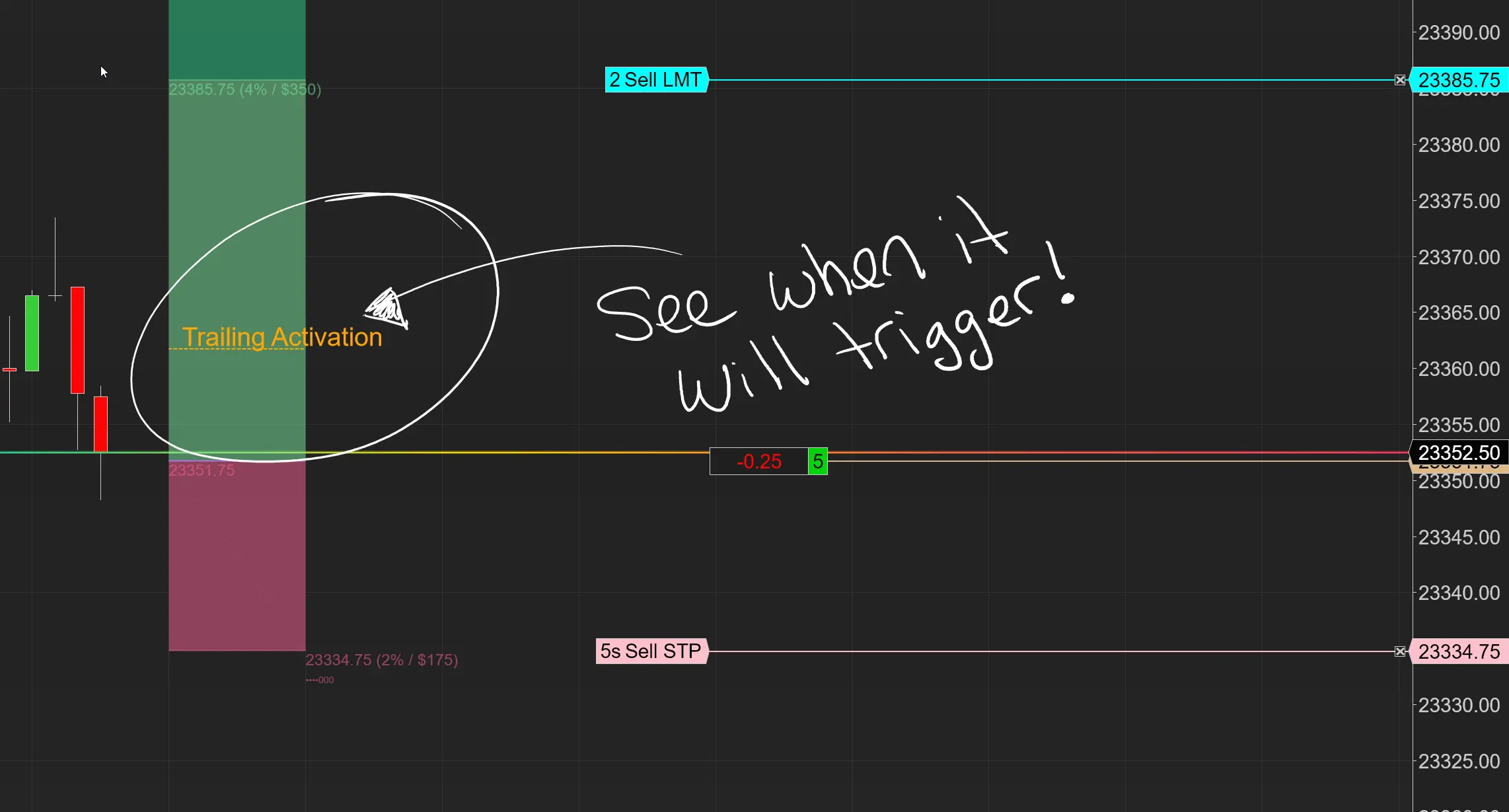

Dominate the Market with Smarter Trailing Stops in NinjaTrader

Jun. 17, 2025

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

May. 28, 2025

NinjaTrader 8.1.5 – They FINALLY Did It!

Apr. 30, 2025

Best ATM Strategy for NinjaTrader 8

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025