XABCD Trading

Best Time Frame for XABCD Patterns

Is the Best Time Frame of XABCD Pattern Real or a Myth?

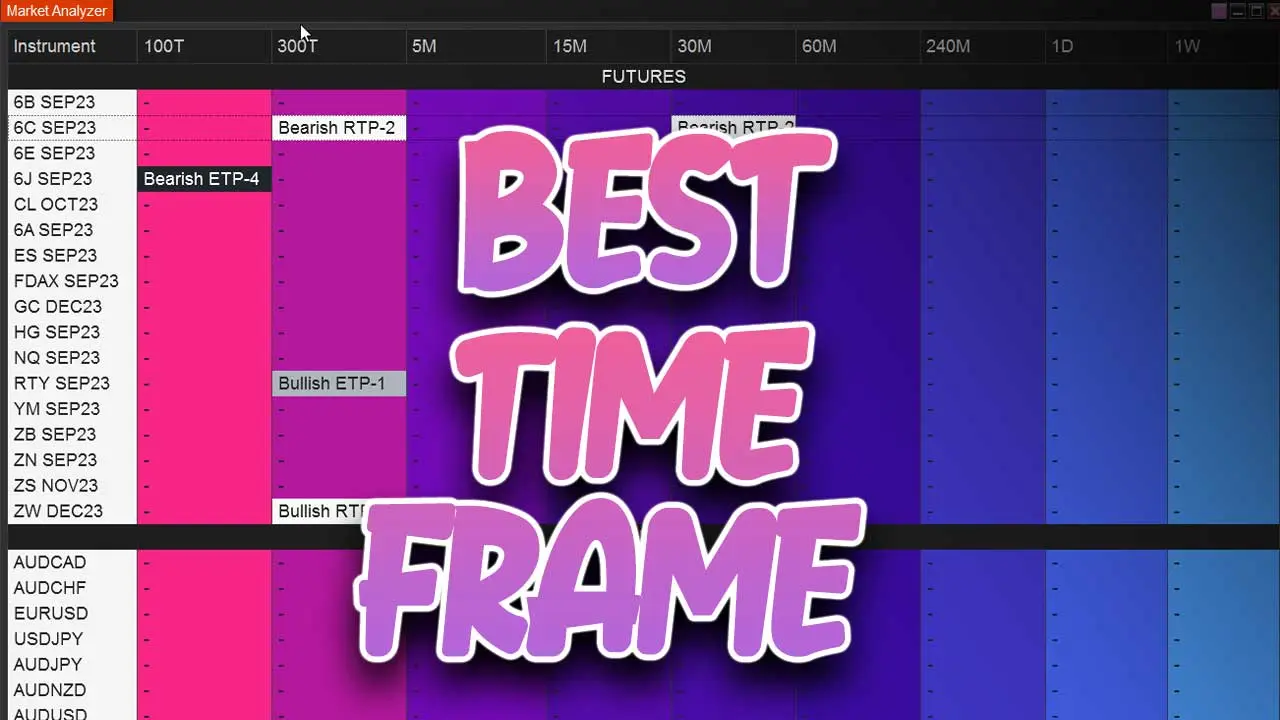

Roughly six years back, we put out a video to mark a significant juncture: the moment our database clocked in a remarkable 1.5 million patterns recorded. It's only natural for you to imagine that such an extensive dataset translates to a wealth of statistics—and your hunch is spot on. Thanks to this robust data, I'm excited to dive into a topic close to my heart: unveiling our insights on the prime time frames for trading XABCD Patterns. So, let's delve into some fascinating findings that shed light on the optimal moments to leverage these patterns effectively.

Spoiler Alert!

It's a complete myth according to the data that one time frame is statistically better over another over a large data set. It's all going to come down to the trader.

What Affects XABCD Pattern Performance Based on Time Frames?

We will discuss three reasons that can affect your time frame selection here. Considering joining our XABCD Pattern Community for the rest of the factors.

Time Availability and Your Career

Let's pick a career... Being a pilot can have a significant impact on the time frame you choose for trading due to the unique schedule and demands of aviation. They probably have an irregular schedule. There will be time zone differences. During your flight you probably have limited availability for checking quotes, monitoring positions etc. You might be under higher street and fatigue. Given this sort of career and daily demand you might take a multi-time frame approach.

Consider opting for longer time frames in your trading strategy, where the need for frequent position monitoring is reduced. This choice could align exceptionally well with your circumstances. For instance, utilizing a 4-hour chart can result in trades that unfold over a span of 5 to 10 days. This extended timeframe provides a significant level of flexibility, particularly when you're not available to oversee trading activities.

During periods when you're away due to your pilot commitments, you can leverage tools like the ATM Pack. This collection offers an array of automated features designed to act as reliable "helpers" for your trades. For instance, one of the ATM presets within the pack facilitates the automatic adjustment of your stop-loss to breakeven, where it remains until you're ready to manage it further. This allows for enhanced trade management even when you're not actively monitoring the markets. There is always a time frame you can trade, just need to find the right one.

During periods when you're away due to your pilot commitments, you can leverage tools like the ATM Pack. This collection offers an array of automated features designed to act as reliable "helpers" for your trades. For instance, one of the ATM presets within the pack facilitates the automatic adjustment of your stop-loss to breakeven, where it remains until you're ready to manage it further. This allows for enhanced trade management even when you're not actively monitoring the markets. There is always a time frame you can trade, just need to find the right one.

Your Skill Level Could Determine Your Best Time Frame

Conversely, if you're retired, you enjoy the liberty to select your preferred time frame without constraints. In this scenario, your skill level becomes a key influencer in your decision-making. Opting for a longer time frame offers the advantage of more extensive reaction windows. This extended period grants you ample time for thoughtful consideration of your subsequent steps. As your strategy becomes well-practiced and your execution becomes seamless, you gain the capacity to transition to a shorter time frame, further refining your trading approach.

Risk Tolerance and the Best Time Frame

I hope you're calculating trade risk as a percentage rather than a fixed dollar amount. If that's the case, risking, for example, 0.5% on a trade holds the same weight whether you're trading on a tick chart or a 4-hour swing trade. Therefore, the time frame itself doesn't dictate your risk tolerance in this manner.

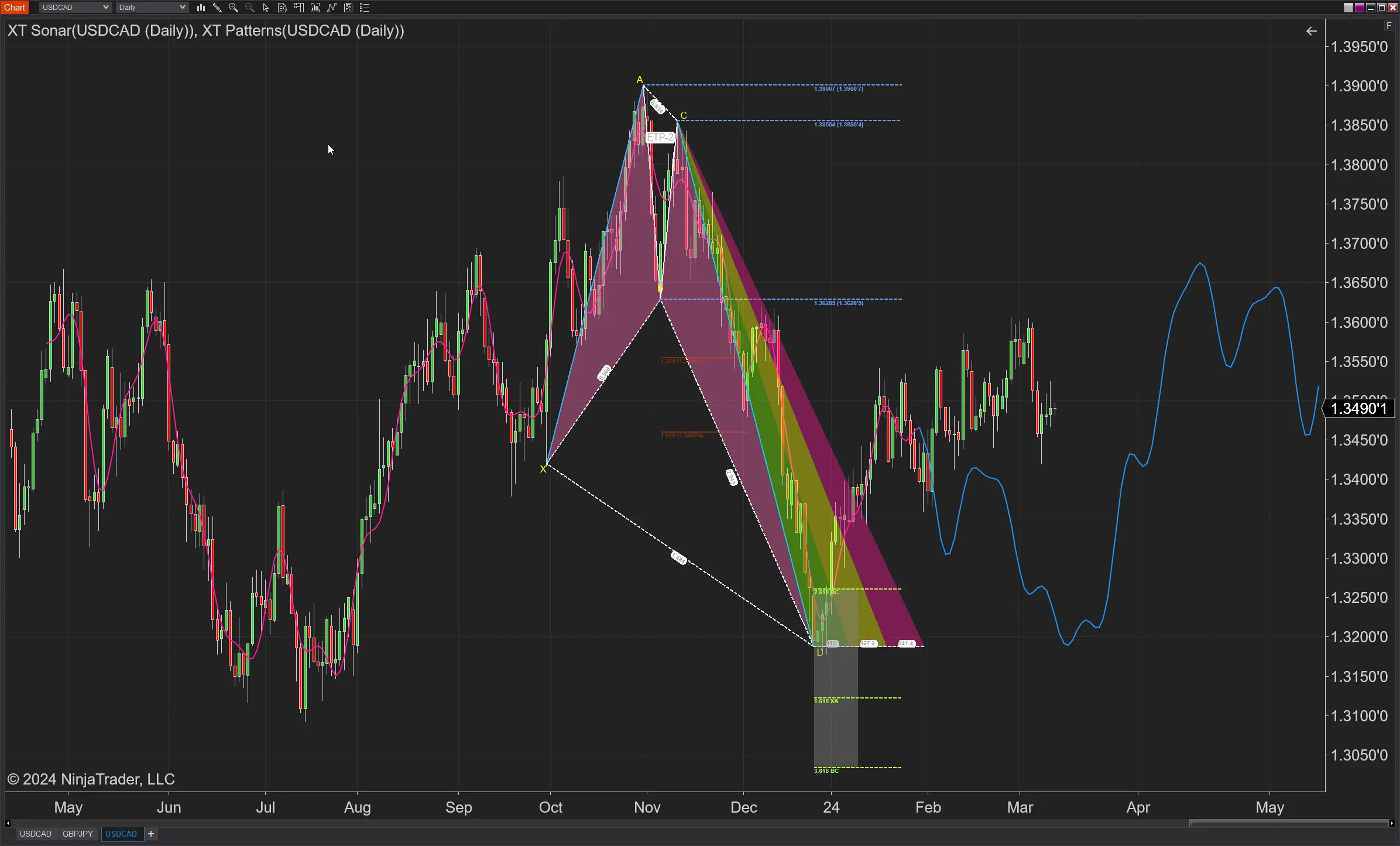

However, where time frame does impact risk tolerance is in the context of holding trades over longer periods. Longer time frames necessitate overnight holding, introducing a level of risk. Trades on daily time frames or those intended for swing trading could require you to hold positions over weekends, potentially adding more uncertainty. If these situations exceed your risk tolerance, you might find it prudent to shift to shorter time frames that allow for quicker exits and avoid extended holding periods.

However, where time frame does impact risk tolerance is in the context of holding trades over longer periods. Longer time frames necessitate overnight holding, introducing a level of risk. Trades on daily time frames or those intended for swing trading could require you to hold positions over weekends, potentially adding more uncertainty. If these situations exceed your risk tolerance, you might find it prudent to shift to shorter time frames that allow for quicker exits and avoid extended holding periods.

How The Size of The XABCD Pattern Matters

The bigger the pattern, the longer it seems to take to play out. There is a calculation we use in our live streams to figure this part out. While we won't be covering that topic here, you can also figure out a way to project and estimate the reversal time too.

In general, just think, the bigger the pattern the longer. So a pattern made up of 20 bars will take less time to play out than a pattern that is made up of 40 bars.

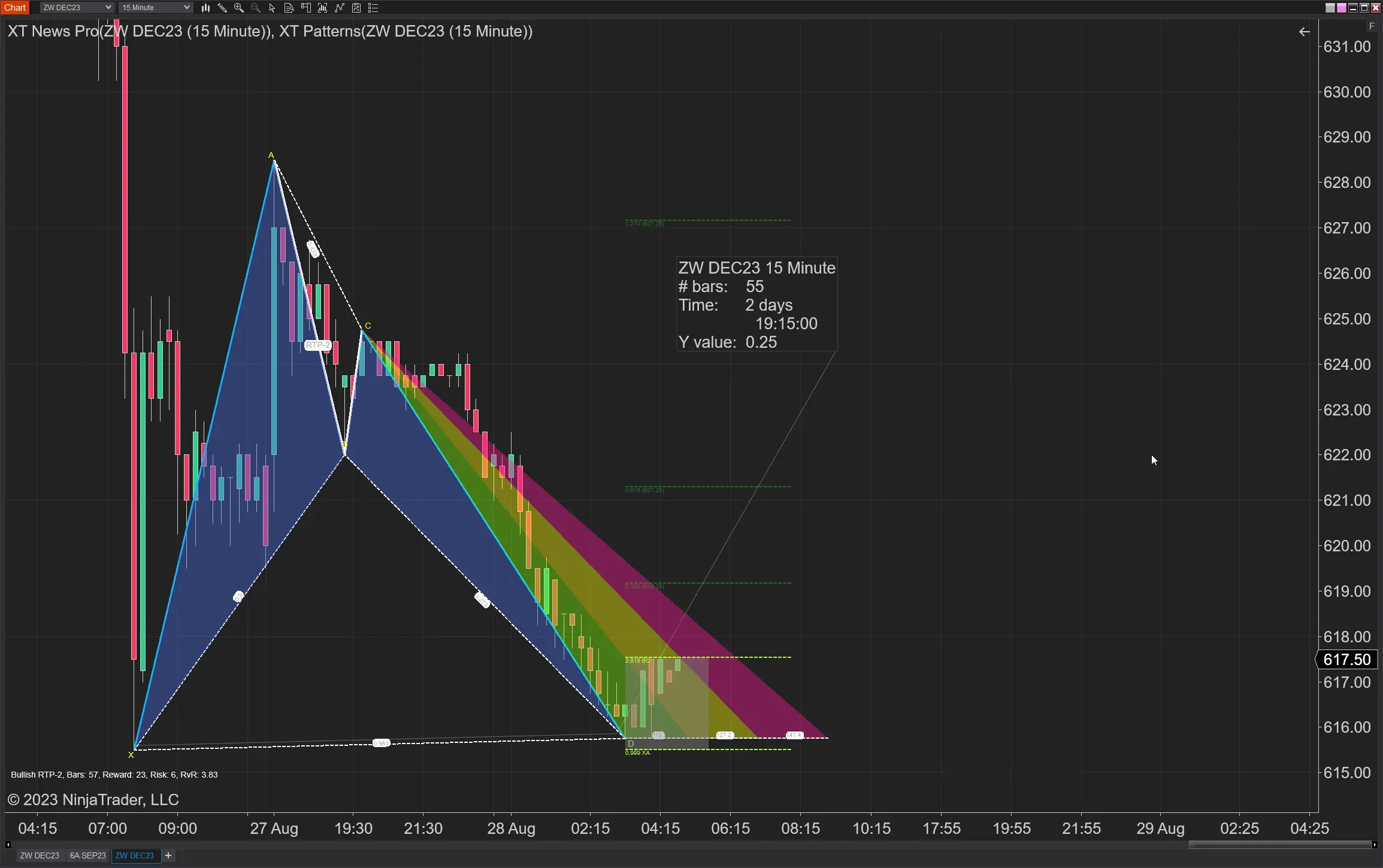

In the example below you will see a pattern 55 bars in size. If we get too low, we won't even want to trade the pattern.

In general, just think, the bigger the pattern the longer. So a pattern made up of 20 bars will take less time to play out than a pattern that is made up of 40 bars.

In the example below you will see a pattern 55 bars in size. If we get too low, we won't even want to trade the pattern.

If you want to learn more about how the size of patterns can impact your trading, consider signing up to all our training and get access to all of our training and see how its done in action.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024

The ETP4 Pattern: Mastering Support and Resistance in Trading

Jul. 03, 2024

Is XABCD Pattern Trading Difficult to Learn?

Apr. 13, 2024

Big Changes in NinjaTrader 8.1.3 New Release

Mar. 13, 2024

How to Trade FOREX in NinjaTrader?

Feb. 19, 2024

Trading Checklist for Pattern Traders

Feb. 16, 2024

NinjaTrader Web vs Desktop Versions

Feb. 16, 2024

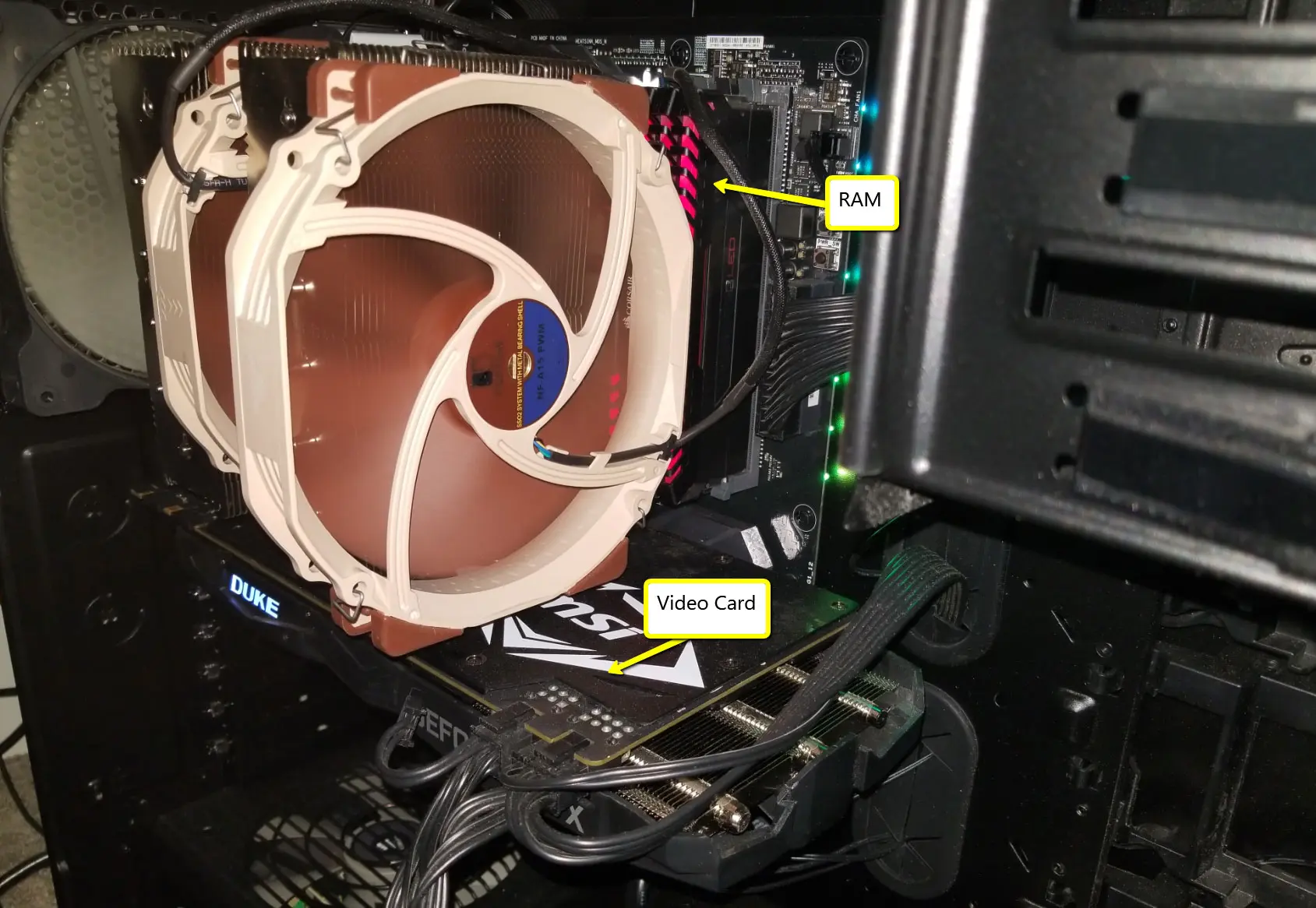

NinjaTrader 8 Realistic System Requirements

Jan. 23, 2024

Bloodhound Economic News Event Indicator

Dec. 21, 2023