XABCD Trading

Ultimate Showdown: NinjaTrader vs. thinkorswim in 2025

Overview of NinjaTrader

In this article, we will compare NinjaTrader and thinkorswim, two prominent trading platforms. We'll provide an overview of each platform, including their key features and benefits. We'll analyze platform accessibility, asset classes, charting, order types, backtesting, market data, fees, stability, and customer support. We'll discuss the pros and cons of both platforms and provide case studies and user experiences. Finally, we'll offer guidance for traders in choosing the platform that suits their needs.

History and Background of NinjaTrader

NinjaTrader, a leading trading platform, has a fascinating background. Launched in 2004, it quickly gained popularity among traders for its user-friendly interface and powerful analysis tools. Originally focused on futures markets, it has since expanded to cover forex, stocks, and more. In 2023 with the release of 8.1, they pulled back from forex and stocks and mainly focused on futures. You can however still trade forex and stocks through NinjaTrader - it's just not their focus. We will have to see if this changes in the future, but at least we have the option.

In 2023, NinjaTrader made a big change and shifted its business model. They started to provide a free license to their software platform if a user opened up a brokerage account. The only catch here is that you would pay higher commissions. For a lot of people just starting out, this is a good trade-off. This would probably increase NinjaTraders market cap and allow them to remove some barriers that kept new traders from using their brokerage services.

What sets NinjaTrader apart is its support for automated trading systems. Traders can develop their own strategies using NinjaScript or explore third-party add-ons. This flexibility empowers traders to customize their experience and optimize their trading approach.

NinjaTrader's partnerships with brokerage firms provide seamless trade execution directly within the platform. No more juggling between different tools for order entry – everything is streamlined for convenience. We would however like to see the supported brokerage list grow as it's pretty limited right now.

NinjaTrader's continuous development and commitment to meeting traders' needs have cemented its reputation as a reliable and feature-rich platform. Its focus on technical analysis and automation has attracted a dedicated user base and propelled its success in the trading community.

Key Features and Benefits of NinjaTrader

Key features of NinjaTrader 8 include:

Advanced Charting: NinjaTrader 8 offers powerful and customizable charting capabilities, allowing traders to analyze and visualize market data with a wide range of chart types, indicators, and drawing tools.

Automated Trading: The platform supports automated trading strategies through NinjaScript, enabling traders to develop, backtest, and deploy their own custom algorithms.

Market Analysis: NinjaTrader 8 provides access to real-time market data, allowing traders to stay informed about price movements, volume, and other critical market statistics.

SuperDOM: The SuperDOM feature provides a depth-of-market display, enabling traders to view and place orders directly from the market depth ladder.

Advanced Order Types: NinjaTrader 8 offers various advanced order types, including stop-limit orders, trailing stops, OCO (one-cancels-other), and bracket orders, providing flexibility in trade execution.

Strategy Builder: The Strategy Builder feature simplifies the process of creating and testing trading strategies without the need for programming knowledge.

Market Replay: Traders can replay historical market data within NinjaTrader 8, allowing them to practice and refine their strategies using real-life market conditions.

Backtesting: NinjaTrader 8 offers robust backtesting capabilities, enabling traders to evaluate the performance of their strategies over historical data.

Extensive Ecosystem: NinjaTrader 8 has a vibrant ecosystem of third-party developers and a marketplace where traders can access a wide range of indicators, strategies, and tools to enhance their trading experience.

Brokerage Integration: The platform integrates with various brokerage firms, enabling traders to execute trades directly from the platform with their preferred broker.

Education and Support: NinjaTrader provides extensive educational resources, including webinars, tutorials, and documentation, to help traders maximize their understanding and utilization of the platform. Additionally, customer support is available to assist users with any questions or technical issues they may encounter.

Overview of thinkorswim

Thinkorswim is a trading platform offered by TD Ameritrade. It has advanced tools for active traders, including real-time data, charting, and order types. However, platforms like NinjaTrader offer better features.

Thinkorswim has customizable interfaces and scanning capabilities, but its high commission fees deter frequent traders. They have a pretty high commission structure competitive compared to other platforms that offer similar or even superior features at lower costs.

Key Features and Benefits of thinkorswim

Advanced Charting Tools: Thinkorswim provides highly advanced and customizable charting capabilities. Traders can access a wide range of technical indicators, drawing tools, and charting styles to conduct in-depth technical analysis and make informed trading decisions.

Real-time Data and News: Thinkorswim offers real-time streaming market data and their big marketing push is that they don't charge fees for their platform or data. This is a big positive (perhaps if your only paper trading) However, don't think you're not going to be paying for it in other ways once you go live.

For example, to trade a futures contract on TOS is 2.25 per trade, plus regulatory and exchange fees. NinjaTrader on the other hand will charge as low as $0.59 per contact. That's a difference of $1.66 per contact. Considering futures data would cost only around $12 a month, if you place just 8 trades a month you would have covered your data fees.

Number of Trades per Month

Thinkorswim Costs

NinjaTrader Costs

Savings with NinjaTrader

5

$11.25

$2.95

$8.30

10

$22.50

$5.90

$8.30

20

$45.00

$11.80

$33.20

50

$112.50

$29.50

$83.00

100

$225.00

$59.00

$166.00

Many Market Types: Thinkorswim allows you to trade all sorts of asset classes under one account. This means you don't have to have a separate broker to trade FX vs Futures as it can all be done under your one account.

Platform Accessibility and Usability

NinjaTrader and Thinkorswim offer different approaches to platform accessibility and usability. While both platforms have their strengths, NinjaTrader stands out in several areas, making it an appealing choice for traders.

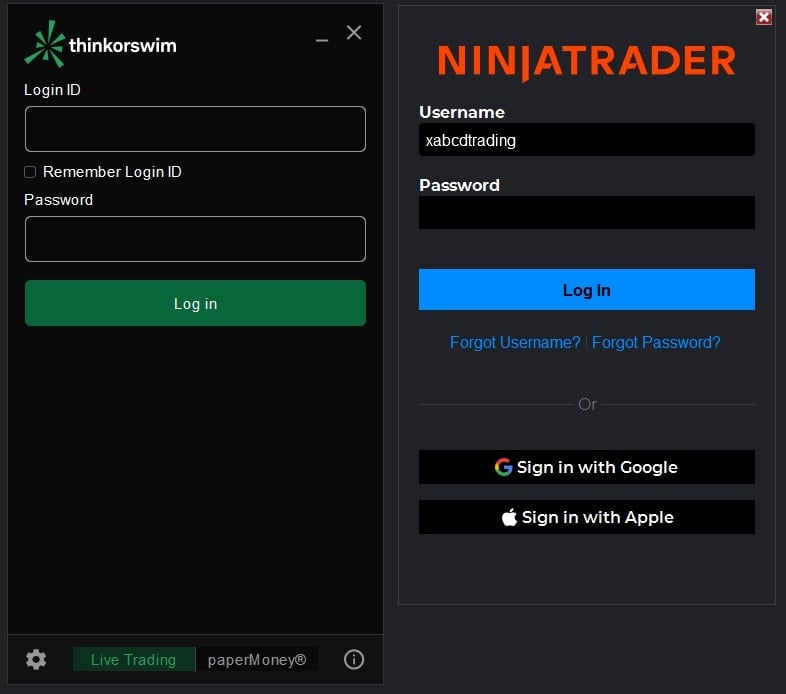

User Interface and Design

Thinkorswim: Thinkorswim is a web-based platform accessible through a web browser and mobile apps. While this provides convenience across different operating systems, the web-based nature may limit the overall performance and speed compared to a dedicated desktop platform.

NinjaTrader: NinjaTrader is primarily a desktop-based platform, offering a downloadable software that provides a robust and feature-rich trading experience. In January 2022, NinjaTrader acquired Tradovate in order to provide a better web based and mobile platform. Their primary focus is still NinjaTrader Desktop and hopefully, that won't be changing. So NinjaTrader right now would be better suited for the Desktop type trader.

Desktop, Web, and Mobile Accessibility

NinjaTrader: NinjaTrader offers a comprehensive and flexible platform that caters to experienced traders and those interested in algorithmic trading or being able to write their own custom scripts or software to layer on top of the NinjaTrader platform. NinjaTrader Desktop (as its now called) is their primary focus in comparison to Thinkorswim's web based approach. Traders who value in-depth analysis and customization options may find NinjaTrader more appealing.

Thinkorswim: Thinkorswim is known for its user-friendly interface its extensive range of tools and functionalities. However, it uses a scripting-type language if you wanted to try to do anything additional. This will limit your platform's ability to do much beyond what is built in already. They also focus on a big web presence.

Ultimately, the choice between NinjaTrader and Thinkorswim depends on individual preferences and trading needs. While Thinkorswim offers accessibility and user-friendliness, NinjaTrader's desktop-based approach, enhanced performance, and advanced features make it a compelling option for traders who prioritize stability, customization, and algorithmic trading capabilities.

Asset Classes and Market Access

Ultimately, the choice between NinjaTrader and Thinkorswim depends on individual preferences and trading needs. While Thinkorswim offers accessibility and user-friendliness, NinjaTrader's desktop-based approach, enhanced performance, and advanced features make it a compelling option for traders who prioritize stability, customization, and algorithmic trading capabilities.

Range of Tradable Instruments

NinjaTrader primarily focuses on futures trading, offering access to global futures markets. It also provides limited support for forex trading and stocks/ETFs.

Thinkorswim, on the other hand, offers pretty much everything within one account. It covers stocks, ETFs, options, futures, forex, and fixed income products like bonds.

Global Market Coverage and Exchanges

| Platform | Global Market Coverage | Exchanges Covered |

|---|---|---|

| NinjaTrader | Primarily focused on futures trading | Extensive coverage of futures markets, including commodities, currencies, and stock indices. Connectivity to major futures exchanges. Limited support for forex and stocks/ETFs. |

| Thinkorswim | Wide range of asset class coverage | Coverage of stocks, ETFs, options, futures, forex, and fixed income products. Access to major exchanges for stocks and ETFs in multiple countries. Connectivity to global futures exchanges and forex market. |

Charting and Technical Analysis

When comparing charting capabilities between NinjaTrader and Thinkorswim, there are a lot of similarities across all trading platforms. They all have your standard set of indicators. What makes the two platform different in my opinion is going to be what can be added to them in order to set each apart.

Charting Tools and Features in NinjaTrader

NinjaTrader main difference is that it has an extensive amount of 3rd party vendors that will basically allow you to achieve all your charting dreams. A good example of an add-on to NinjaTrader is our own XABCD Pattern Suite. This give you new functionality with additional indicators and drawing tools.

Charting Tools and Features in Thinkorswim

Thinkorswim is very competitive with the default set of indicators provided. However, where it falls short is what you can do with their limited thinkscript programming language. There are indicators out there, but their functions are pretty limited.

Order Types and Execution

| Platform | Order Types |

|---|---|

| NinjaTrader | Advanced order types like ATM, OCO (One-Cancels-Other), and trailing stops. Supports automated trading and algorithmic strategies through NinjaScript programming language. Direct market access (DMA) for fast and efficient order execution. Advanced order routing options and connectivity to multiple brokers. |

| Thinkorswim | Bracket orders can be done out of the box in addition to the OCOs, and trailing stops. Offers access to a large selection of third-party trading algorithms through thinkScript library. |

Order Types Supported by NinjaTrader

One of the biggest advantages of using NinjaTrader is its ATM (Advanced Trade Management) feature. This will allow you (without knowing any code) to create graphically a script that will assist in both order entry and stop management. The ATMs are a very unique feature only available in NinjaTrader which you can learn more about ATMs and their benefits.

Order Types Supported by thinkorswim

One of the biggest advantages of using NinjaTrader is its ATM (Advanced Trade Management) feature. This will allow you (without knowing any code) to create graphically a script that will assist in both order entry and stop management. The ATMs are a very unique feature only available in NinjaTrader which you can learn more about ATMs and their benefits.

Order Execution Speed and Reliability Comparison

| Platform | Order Execution Speed and Reliability |

|---|---|

| NinjaTrader | Known for direct market access (DMA) capabilities, offering fast and efficient order execution. Advanced order routing options and connectivity to multiple brokers. |

| Thinkorswim | Reliable order execution through TD Ameritrade's established network. Offers satisfactory execution speed for most trading strategies. |

Advanced Order Features Analysis

Thinkorswim has a unique advanced order features worth mentioning. The first is called their "Active Trader Ladder" which offers a dynamic and visual interface for trading stocks and options. Traders can view real-time market depth, place orders directly from the ladder, and monitor order status and executions.

NinjaTrader's SuperDOM (Depth of Market) provides a comprehensive view of market depth and allows traders to place orders directly from the DOM interface. It offers quick order entry, real-time position tracking, and advanced order management features.

Backtesting and Strategy Development

Backtesting Capabilities in NinjaTrader

- Robust backtesting and strategy development capabilities via custom coding or the ninjatrader strategy tester

- Offers a comprehensive strategy development environment using NinjaScript programming language.

- NinjaTrader lets you program in c# whereas thinkorswim only allows you to do scripting which limits things

- Extensive tools and resources for algorithmic and systematic traders.

- Ability to backtest strategies using historical data and simulate real-time trading conditions.

- Access to a large library of pre-built indicators and strategies that can be customized.

Backtesting Capabilities in thinkorswim

- Provides backtesting and strategy development features through thinkScript programming language which is pretty limited

- May have relatively basic backtesting capabilities compared to NinjaTrader using something called "On-Demand" which is similar to NinjaTrader's "Market Reply".

Strategy Development Environment in NinjaTrader

Strategy Builder: NinjaTrader offers a visual strategy builder that enables traders to develop automated trading strategies without coding. The strategy builder utilizes a drag-and-drop interface, allowing users to create rules and conditions using pre-defined building blocks.

NinjaScript: For more advanced traders and developers, NinjaTrader provides NinjaScript, a proprietary programming language. With NinjaScript, traders can create custom indicators, strategies, and functions using C# syntax. This offers greater flexibility and control over strategy development.

Backtesting: The Strategy Development Environment in NinjaTrader includes a robust backtesting feature. Traders can test their strategies against historical market data to evaluate their performance and profitability. The backtesting feature allows users to adjust parameters, simulate real-time trading, and analyze trade results and statistics.

Optimization: NinjaTrader's SDE allows traders to optimize their strategies by testing different combinations of parameters. Users can specify ranges for various parameters, and NinjaTrader will perform multiple backtests to find the optimal values. This helps traders fine-tune their strategies for improved performance.

Real-time Simulated Trading: Once a strategy is developed and backtested, NinjaTrader provides a simulated trading environment where traders can execute trades based on their automated strategies. This allows users to test their strategies in real-time market conditions without risking actual capital.

Market Analyzer: The Strategy Development Environment integrates with NinjaTrader's Market Analyzer, which provides a customizable real-time scanning and alert system. Traders can use the Market Analyzer to monitor multiple instruments and identify trading opportunities based on their strategy's conditions.

Strategy Development Environment in thinkorswim

thinkScript: Thinkorswim's proprietary scripting language, thinkScript, is at the core of the Strategy Development Environment. It enables traders to create custom studies, strategies, and alerts using a syntax similar to C#. With thinkScript, traders can define their entry and exit conditions, implement technical indicators, and develop complex trading strategies.

thinkBack: thinkBack is a historical analysis tool within Thinkorswim that allows traders to backtest their strategies using historical market data. Traders can select a specific date range and replay the market to assess how their strategies would have performed in the past. It provides a simulated trading environment to evaluate strategy effectiveness.

OnDemand: Similar to thinkBack, OnDemand is a feature in Thinkorswim that allows traders to replay historical market data as if they were trading in real time. This feature helps traders analyze and test their strategies against past market conditions, enabling them to refine and optimize their approaches.

Paper Trading: Thinkorswim's paper trading feature is seamlessly integrated with the Strategy Development Environment. Traders can practice and test their strategies in a simulated trading environment using virtual money. This allows traders to gain confidence in their strategies before deploying them in live trading.

Strategy Roller: The Strategy Roller feature in Thinkorswim allows traders to automate their trading strategies by specifying entry and exit conditions, position sizing, and risk management rules. Traders can backtest and deploy their strategies using real-time market data or historical data. The Strategy Roller also supports trailing stops and other order types.

StrategyDesk: Thinkorswim's StrategyDesk is a powerful tool within the Strategy Development Environment that offers advanced charting, customization, and backtesting capabilities. It provides a comprehensive platform for strategy development and analysis.

Summary of SDE NinjaTrader vs thinkorswim

| Feature | NinjaTrader | Thinkorswim |

|---|---|---|

| User Interface | Advanced and technical interface | User-friendly interface with visual tools |

| Strategy Development Options | Visual strategy builder and NinjaScript (coding) | thinkScript scripting language |

| Backtesting Features | Highly customizable options | thinkBack and OnDemand for historical analysis |

| Simulated Trading | Integrated simulated trading environment | Integrated paper trading feature |

| Integration | Extensive third-party integration options | All-in-one platform by TD Ameritrade |

| Community and Support | Active user community and support | Supportive community and resources from TD Ameritrade |

Market Data and Research

Market Data Access and Quality in NinjaTrader

NinjaTrader offers flexible market data access, providing traders with a range of options to access real-time and historical market data. Here's an overview of the market data access in NinjaTrader:

Supported Data Providers: NinjaTrader supports a variety of data providers, including major brokerage firms, data feed providers, and supported exchanges. Some popular data providers compatible with NinjaTrader include CQG, Rithmic, TD Ameritrade, Interactive Brokers, and Kinetick.

Supported Data Providers: NinjaTrader supports a variety of data providers, including major brokerage firms, data feed providers, and supported exchanges. Some popular data providers compatible with NinjaTrader include CQG, Rithmic, TD Ameritrade, Interactive Brokers, and Kinetick.

Real-Time Market Data: Traders can access real-time market data for a wide range of financial instruments, including stocks, futures, options, and forex. Real-time data includes streaming quotes, charts, time and sales, level II market depth, and other relevant market information.

Historical Market Data: NinjaTrader provides access to extensive historical market data, allowing traders to analyze past market conditions. Historical data can be used for backtesting strategies, conducting research, and analyzing historical price and volume information.

Tick-by-Tick Data: NinjaTrader supports tick-by-tick data, which provides detailed information on each individual trade or quote. This level of data granularity is useful for traders who require precise market data for their analysis and strategy development.

Market Replay: NinjaTrader's market replay feature allows traders to replay historical market data in real time. Traders can simulate trading sessions, review historical price movements, and practice their strategies using replayed market data.

Connection Options: NinjaTrader provides multiple connectivity options for accessing market data. Traders can connect to data providers directly, through supported brokerage accounts, or by utilizing NinjaTrader's own data feed service, Kinetick.

Customizable Timeframes: Traders can select various timeframes for their market data, such as tick charts, minute charts, daily charts, or custom intervals. This allows for flexible analysis and strategy development based on specific timeframes.

Market Data Access and Quality in thinkorswim

Real-Time Market Data: Thinkorswim provides real-time market data for various asset classes, including stocks, options, futures, and forex. Traders can access streaming quotes, charts, level II market depth, time and sales data, and other relevant market information.

Extensive Instrument Coverage:: Thinkorswim offers access to a wide range of financial instruments, including equities, ETFs, mutual funds, options, futures, forex, and fixed income products. Traders can analyze and trade these instruments using real-time market data.

Historical Market Data: Thinkorswim provides historical market data for backtesting strategies and conducting research. Traders can access historical price and volume data for different timeframes and intervals. The thinkBack feature allows users to analyze historical options data as well.

Differences in Market Data with NinjaTrader vs thinkorswim

| Feature | NinjaTrader | Thinkorswim |

|---|---|---|

| User Interface | Advanced and technical interface | User-friendly interface with visual tools |

| Strategy Development Options | Visual strategy builder and NinjaScript (coding) | thinkScript scripting language |

| Backtesting Features | Highly customizable options | thinkBack and OnDemand for historical analysis |

| Simulated Trading | Integrated simulated trading environment | Integrated paper trading feature |

| Integration | Extensive third-party integration options | All-in-one platform by TD Ameritrade |

| Community and Support | Active user community and support | Supportive community and resources from TD Ameritrade |

Trading Commissions Comparison

Trading Commissions Comparison

NinjaTrader and Thinkorswim, as trading platforms, differ in their approach to trading commissions. NinjaTrader offers a transparent and flexible pricing structure. Traders can choose from different brokerage partners, and the commissions depend on the specific broker and trading account. NinjaTrader provides a variety of commission plans, including per-share, per-contract, and flat-rate options, allowing traders to select the most suitable pricing model based on their trading style and volume.

On the other hand, Thinkorswim follows a commission structure primarily based on a per-trade basis. Thinkorswim offers competitive commission rates for various asset classes, such as stocks, options, futures, and forex. The commission fees vary depending on factors like trade size, asset type, and trading volume. Thinkorswim also provides different commission tiers based on the trader's account status, offering potential discounts for frequent traders or account holders with higher balances.

| Feature | NinjaTrader | Thinkorswim |

|---|---|---|

| Pricing Structure | Flexible commission plans based on brokerage partners | Commission structure primarily based on per-trade basis |

| Commission Types | Per-share, per-contract, and flat-rate options | Primarily per-trade commissions |

| Asset Classes | Stocks, options, futures, forex | Stocks, options, futures, forex |

| Commission Tiers | Varies depending on the broker and trading account | Tiers based on account status and trading volume |

Data Fees and Market Access Costs

NinjaTrader 8 and Futures Data: You can get free futures data on NinjaTrader 8 but you need to use interactive brokers and do over $20 in commissions. The cheapest option for most that isn't free would be through NinjaTrader. They charge $4 per exchange or $12 for the bundle. TD-Ameritrade data can not be connected to NinjaTrader 8 due to the limitations of the TDA api.

NinjaTrader 8 and Forex Data: Forex data should be free because there isn't one central exchange and thus you can get data from anywhere. FXCM (for non US residence) is going to be the place for you to get data. If you are a US resident then you will need to use Forex.com. Interactive brokers forex data would also work for all users.

Thinkorswim Market Data: thinkorswim data is free. However, you will pay vast amounts of commission to cover those fees and then some. So choose carefully. If you look at your commission costs in a month you might be shocked to see your spending over $100 when you could just spend a quarter of that if you just paid $12 for data via NinjaTrader.

Platform Stability and Reliability

Platform Performance Analysis for NinjaTrader

NinjaTrader has been around for many years and has gained a significant user base. It is known for its robustness and stability, allowing users to execute trades, analyze market data, and develop and test trading strategies. The platform also provides access to various markets and data feeds.

Platform Performance Analysis for thinkorswim

Thinkorswim is where a lot of traders might start off because it could be part of their bank. So they do get a lot of customers and thus, the platform is pretty stable due to its size and popularity. So they are pretty much on part with a lot of the options out there. If your going to be one of the more popular options, you can probably assume their stability has been sorted out.

However, it's important to note that software stability can be influenced by various factors, including individual user setups, network connectivity, and occasional software updates. While Thinkorswim is generally reliable, there is always a possibility of occasional technical issues or outages. It's a good practice to keep the platform updated with the latest version and have a stable internet connection to ensure smooth operation.

It's also worth mentioning that the experiences and opinions of users can vary. If you are considering using Thinkorswim, it may be beneficial to read more recent user reviews and forums to get up-to-date feedback on its stability and reliability.

Customer Support and Resources

Support Options and Responsiveness for NinjaTrader

NinjaTrader offers many different support channels. They have a live chat that is open 24/5 that is managed by an AI to start but can get you to a human. Phone and email are also options.

Support Options and Responsiveness for thinkorswim

They do seem to have a live chat, but only once you have the platform installed and not through the website. This means trying to get pre-sale type questions answered is going to be through a phone or email.

Educational and Training Resources Offered

Both NinjaTrader and Thinkorswim offer comprehensive trading education resources, but the effectiveness and preference of educational materials can vary depending on individual needs and learning styles. It's subjective to determine which platform offers better trading education as it ultimately depends on your specific requirements and preferences. Here are some factors to consider:

Content: Evaluate the range and depth of educational materials provided by each platform. Look for resources that align with your trading goals, such as beginner-friendly tutorials, advanced trading strategies, technical analysis techniques, or specific market insights.

Format: Consider your preferred learning style. Do you prefer video tutorials, written guides, interactive courses, or webinars? Check if the platform offers resources in the formats that resonate with your learning preferences.

Clarity and Accessibility: Assess the clarity and ease of understanding of the educational content. Look for user-friendly resources that explain concepts in a clear and concise manner. Also, consider how easily accessible and navigable the educational materials are within the platform.

Community and Support: Consider the availability of a supportive community or dedicated customer support that can assist you with any questions or clarifications regarding the educational content.

To determine which platform offers better trading education for you, it's recommended to explore the educational resources provided by both NinjaTrader and thinkorswim firsthand. Take advantage of free trials or demo accounts to assess the quality and relevance of the materials to your trading journey. Additionally, seek feedback from other traders or online communities who have used these platforms to gain insights into their educational offerings.

Content: Evaluate the range and depth of educational materials provided by each platform. Look for resources that align with your trading goals, such as beginner-friendly tutorials, advanced trading strategies, technical analysis techniques, or specific market insights.

Format: Consider your preferred learning style. Do you prefer video tutorials, written guides, interactive courses, or webinars? Check if the platform offers resources in the formats that resonate with your learning preferences.

Clarity and Accessibility: Assess the clarity and ease of understanding of the educational content. Look for user-friendly resources that explain concepts in a clear and concise manner. Also, consider how easily accessible and navigable the educational materials are within the platform.

Community and Support: Consider the availability of a supportive community or dedicated customer support that can assist you with any questions or clarifications regarding the educational content.

To determine which platform offers better trading education for you, it's recommended to explore the educational resources provided by both NinjaTrader and thinkorswim firsthand. Take advantage of free trials or demo accounts to assess the quality and relevance of the materials to your trading journey. Additionally, seek feedback from other traders or online communities who have used these platforms to gain insights into their educational offerings.

Pros and Cons of NinjaTrader

| Pros of NinjaTrader | Cons of NinjaTrader |

|---|---|

| Advanced Charting | Steep Learning Curve |

| Automated Trading | Limited Brokerage Options |

| Backtesting | Platform Stability |

| Market Analysis Tools | Cost |

| Third-Party Integration | User Interface |

Pros of NinjaTrader:

Advanced Charting: NinjaTrader offers powerful and customizable charting capabilities, allowing users to analyze market data using various indicators, drawing tools, and time frames.

Automated Trading: The platform supports automated trading strategies, enabling users to develop and implement their own algorithms or utilize pre-built trading systems.

Backtesting: NinjaTrader provides robust backtesting functionality, allowing users to test trading strategies on historical data to evaluate their performance.

Market Analysis Tools: NinjaTrader offers a wide range of technical analysis tools, including advanced order flow analytics, market profile, and volume analysis, which can assist in making informed trading decisions.

Third-Party Integration: The platform allows integration with various third-party tools and data providers, giving users access to additional resources and services.

Cons of NinjaTrader:

Steep Learning Curve: NinjaTrader can be complex and may have a steeper learning curve compared to some other trading platforms, especially for novice traders.

Limited Brokerage Options: NinjaTrader primarily supports its in-house brokerage services and a few select external brokers. This limited selection may restrict some users who prefer specific brokerage options.

Platform Stability: While NinjaTrader is generally stable, occasional technical issues or glitches may occur. Users should ensure they have a stable internet connection and keep the platform updated to minimize disruptions.

Cost: NinjaTrader offers different versions of its platform, including a free version (with limited features) and paid options with additional functionalities. The costs associated with the platform and data feeds may be a consideration for some users.

User Interface: The user interface of NinjaTrader may not be as intuitive or visually appealing as some other trading platforms. It may take some time for users to get accustomed to the layout and functionality.

It's important to note that the perceived pros and cons of NinjaTrader can vary based on individual preferences and requirements. It's recommended to try out a demo or trial version of the platform to assess if it meets your specific trading needs before making a decision.

Advanced Charting: NinjaTrader offers powerful and customizable charting capabilities, allowing users to analyze market data using various indicators, drawing tools, and time frames.

Automated Trading: The platform supports automated trading strategies, enabling users to develop and implement their own algorithms or utilize pre-built trading systems.

Backtesting: NinjaTrader provides robust backtesting functionality, allowing users to test trading strategies on historical data to evaluate their performance.

Market Analysis Tools: NinjaTrader offers a wide range of technical analysis tools, including advanced order flow analytics, market profile, and volume analysis, which can assist in making informed trading decisions.

Third-Party Integration: The platform allows integration with various third-party tools and data providers, giving users access to additional resources and services.

Cons of NinjaTrader:

Steep Learning Curve: NinjaTrader can be complex and may have a steeper learning curve compared to some other trading platforms, especially for novice traders.

Limited Brokerage Options: NinjaTrader primarily supports its in-house brokerage services and a few select external brokers. This limited selection may restrict some users who prefer specific brokerage options.

Platform Stability: While NinjaTrader is generally stable, occasional technical issues or glitches may occur. Users should ensure they have a stable internet connection and keep the platform updated to minimize disruptions.

Cost: NinjaTrader offers different versions of its platform, including a free version (with limited features) and paid options with additional functionalities. The costs associated with the platform and data feeds may be a consideration for some users.

User Interface: The user interface of NinjaTrader may not be as intuitive or visually appealing as some other trading platforms. It may take some time for users to get accustomed to the layout and functionality.

It's important to note that the perceived pros and cons of NinjaTrader can vary based on individual preferences and requirements. It's recommended to try out a demo or trial version of the platform to assess if it meets your specific trading needs before making a decision.

Pros and Cons of thinkorswim

| Pros of NinjaTrader | Cons of NinjaTrader |

|---|---|

| Advanced Charting | Steep Learning Curve |

| Automated Trading | Limited Brokerage Options |

| Backtesting | Platform Stability |

| Market Analysis Tools | Cost |

| Third-Party Integration | User Interface |

Pros of Thinkorswim:

Advanced Trading Tools: Thinkorswim offers a wide range of advanced trading tools, including advanced charting capabilities, technical analysis indicators, customizable scanners, and in-depth options trading features.

Extensive Educational Resources: Thinkorswim provides a wealth of educational resources, including video tutorials, articles, webcasts, and interactive courses, to help traders learn about the platform, trading strategies, and market analysis.

Paper Trading: Thinkorswim offers a simulated trading environment, allowing users to practice trading without risking real money. This feature is beneficial for beginners to gain experience and test trading strategies.

Active Trader Community: Thinkorswim has a vibrant community of active traders who share insights, trading ideas, and strategies. Engaging with the community can provide valuable market perspectives and foster learning.

Access to Multiple Markets: Thinkorswim provides access to various markets, including stocks, options, futures, and forex, allowing users to diversify their trading activities.

Cons of Thinkorswim:

Complex User Interface: The platform can appear overwhelming for novice traders due to its extensive features and customizable options. It may take some time for users to become familiar with the interface and effectively navigate the platform.

Steep Learning Curve: Thinkorswim's comprehensive features and advanced tools may have a steep learning curve, requiring users to invest time in understanding the platform and its functionalities.

Higher Minimum Deposit: Thinkorswim requires a minimum deposit to open a trading account, which may be a consideration for traders with limited funds or those looking for lower initial investment requirements.

Reliance on TD Ameritrade: Thinkorswim is part of TD Ameritrade, and its availability and support are dependent on the policies and infrastructure of the parent company. Changes in TD Ameritrade's services or ownership could potentially impact Thinkorswim users.

Platform Stability: Although Thinkorswim is generally stable, occasional technical issues or outages can occur. It's important to have a stable internet connection and stay updated with platform updates to minimize disruptions.

Remember that these pros and cons are subjective and can vary depending on individual preferences and trading goals. It's recommended to evaluate your specific needs and preferences when considering Thinkorswim or any trading platform.

Advanced Trading Tools: Thinkorswim offers a wide range of advanced trading tools, including advanced charting capabilities, technical analysis indicators, customizable scanners, and in-depth options trading features.

Extensive Educational Resources: Thinkorswim provides a wealth of educational resources, including video tutorials, articles, webcasts, and interactive courses, to help traders learn about the platform, trading strategies, and market analysis.

Paper Trading: Thinkorswim offers a simulated trading environment, allowing users to practice trading without risking real money. This feature is beneficial for beginners to gain experience and test trading strategies.

Active Trader Community: Thinkorswim has a vibrant community of active traders who share insights, trading ideas, and strategies. Engaging with the community can provide valuable market perspectives and foster learning.

Access to Multiple Markets: Thinkorswim provides access to various markets, including stocks, options, futures, and forex, allowing users to diversify their trading activities.

Cons of Thinkorswim:

Complex User Interface: The platform can appear overwhelming for novice traders due to its extensive features and customizable options. It may take some time for users to become familiar with the interface and effectively navigate the platform.

Steep Learning Curve: Thinkorswim's comprehensive features and advanced tools may have a steep learning curve, requiring users to invest time in understanding the platform and its functionalities.

Higher Minimum Deposit: Thinkorswim requires a minimum deposit to open a trading account, which may be a consideration for traders with limited funds or those looking for lower initial investment requirements.

Reliance on TD Ameritrade: Thinkorswim is part of TD Ameritrade, and its availability and support are dependent on the policies and infrastructure of the parent company. Changes in TD Ameritrade's services or ownership could potentially impact Thinkorswim users.

Platform Stability: Although Thinkorswim is generally stable, occasional technical issues or outages can occur. It's important to have a stable internet connection and stay updated with platform updates to minimize disruptions.

Remember that these pros and cons are subjective and can vary depending on individual preferences and trading goals. It's recommended to evaluate your specific needs and preferences when considering Thinkorswim or any trading platform.

Choosing the Right Platform: Factors to Consider

We looked at all the differences between NinjaTrader and thinkorswim. NinjaTrader stands out as the clear winner for 4 important reasons:

- Customizability: NinjaTrader offers extensive customization options, allowing traders to tailor the platform to their specific trading strategies and preferences. It provides advanced charting tools and flexible order entry capabilities, which can be advantageous for traders who desire more control and customization in their trading experience.

- Automation and Strategy Development: NinjaTrader is known for its robust support for automated trading strategies. Traders can build and implement their own algorithms or use pre-built trading systems. It offers a wide range of development tools and allows for backtesting and optimization of strategies.

- Cost Structure: NinjaTrader offers a free version of its platform with limited features, making it more accessible to traders who are cost-conscious. Additionally, its pricing model for the paid versions tends to be more favorable for active traders or those who require specific add-ons.

- Ecosystem and Third-Party Integration: Just like our XABCD Pattern Suite which runs on NinjaTrader 8.

Frequently Asked Questions

How does Thinkorswim compare to NinjaTrader in terms of charting and technical analysis capabilities?

NinjaTrader is the more cheaper way to trade, unless you're just watching the market and never placing orders. Thinkorswim has very high fees when doing a transaction and should be considered.

How does the user interface and ease of use compare between Thinkorswim and NinjaTrader?

Both platforms will require you to spend some time learning them and are probably on par with each other. NinjaTrader does have some pretty advanced options so you could spend additional time on those if you have very specific needs.

What are the available order types and advanced trading functionalities on Thinkorswim compared to NinjaTrader?

Both are pretty much on par with the educational resources but I do find NinjaTraders offering of how the education is presented live to be more interesting.

- NinjaTrader:

- Allows extensive customization of chart layouts and templates.

- Provides a wide array of drawing tools, indicators, and studies.

- Offers market replay for practicing and backtesting strategies.

- Has a large ecosystem of third-party indicators and tools.

- Offers advanced charting with customizable studies and technical indicators.

- Includes market profile charts for analyzing volume distribution.

- Provides powerful scanning tools to identify trading opportunities.

- Supports the thinkScript language for creating custom studies and strategies.

Thinkorswim:

NinjaTrader is the more cheaper way to trade, unless you're just watching the market and never placing orders. Thinkorswim has very high fees when doing a transaction and should be considered.

How does the user interface and ease of use compare between Thinkorswim and NinjaTrader?

Both platforms will require you to spend some time learning them and are probably on par with each other. NinjaTrader does have some pretty advanced options so you could spend additional time on those if you have very specific needs.

What are the available order types and advanced trading functionalities on Thinkorswim compared to NinjaTrader?

- Thinkorswim:

- Order Types: OCO (One-Cancels-the-Other) and contingent orders.

- Advanced Trading Functionalities: Advanced options trading tools, spread trading, options rolling, multi-leg options strategies, custom watchlists, and advanced scanning capabilities.

- NinjaTrader:

- Order Types: Bracket orders.

- Advanced Trading Functionalities: Automated trading strategies through NinjaScript development environment, custom indicators and strategies using C# programming language, backtesting capabilities, and market replay for practice trading.

Both are pretty much on par with the educational resources but I do find NinjaTraders offering of how the education is presented live to be more interesting.

Resources and Further Reading

Jun. 17, 2025

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

May. 28, 2025

NinjaTrader 8.1.5 – They FINALLY Did It!

Apr. 30, 2025

Best ATM Strategy for NinjaTrader 8

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024